Boeing Employees’ Credit Union was founded in 1935 and it operates as not-for-profit credit union. It has a network of locations in Seattle, Tacoma, and Bellevue.

- Branch / ATM Locator

- Website: https://www.becu.org/

- Routing Number: 325081403

- Swift Code: See Details

- Telephone Number: +1 800-233-2328

- Mobile App: Android | iPhone

- Founded: 1935 (89 years ago)

- Bank's Rating:

The internet has made it easy for people around the world to do many things that were not possible before, and Boeing Employees Credit Union has taken advantage of that by offering internet banking services which allow customers to manage their bank accounts from anywhere around the globe. The bank’s online platform has an easy to easy to use platform and it’s free to register. In this post, we will guide you through the process of accessing your online account, retrieving your password and enrolling for the internet banking services.

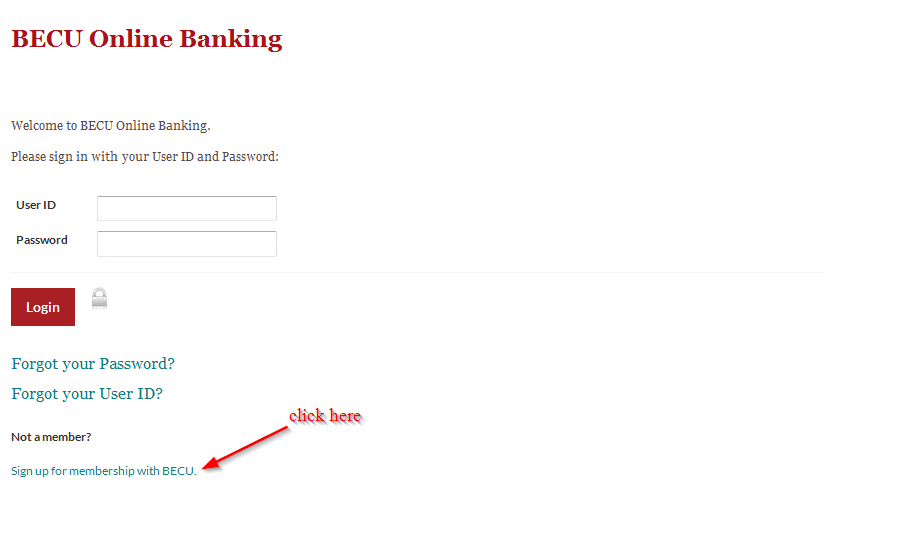

How to login

This is the simplest part of the internet banking services offered by the bank. All you need is your login details, a computer and reliable internet connection. You can also download an app on your phone and login. Here are the steps you will follow to login:

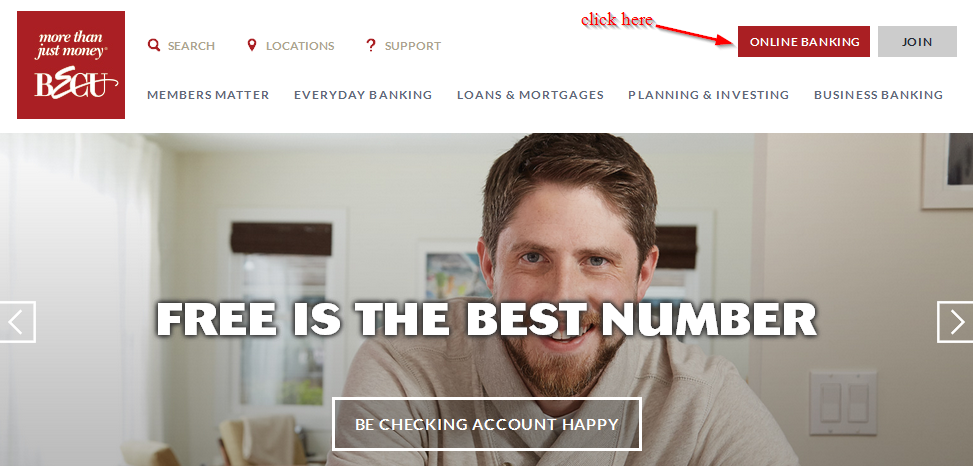

Step 1-Start your PC, open your web browser and type in https://www.becu.org/

Step 2-Click “online banking”

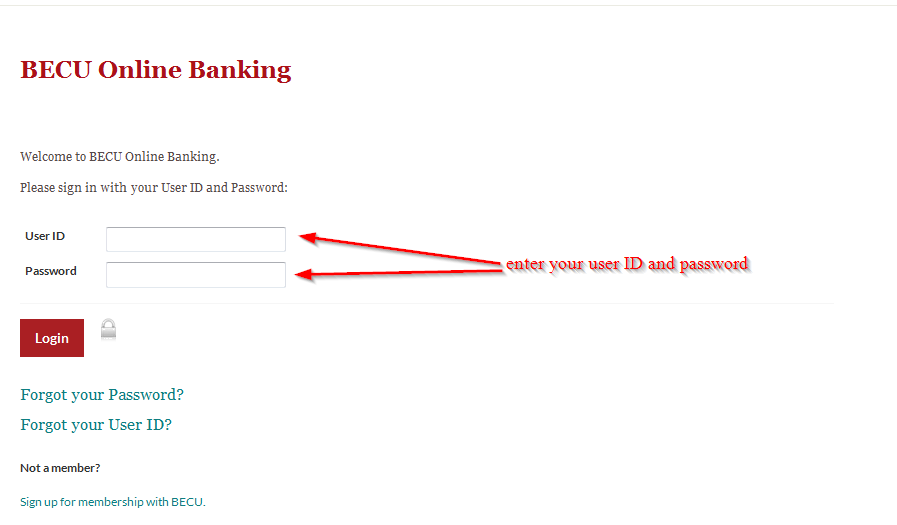

Step 3-Enter your user ID and password and click “login”

How to reset your password

If you can access your online account, you can reset the password. You will need your login ID to do so. This is an important security measures to ensure that you are a valid member with an online account with the bank. Follow this step-by-step guide to retrieve your password:

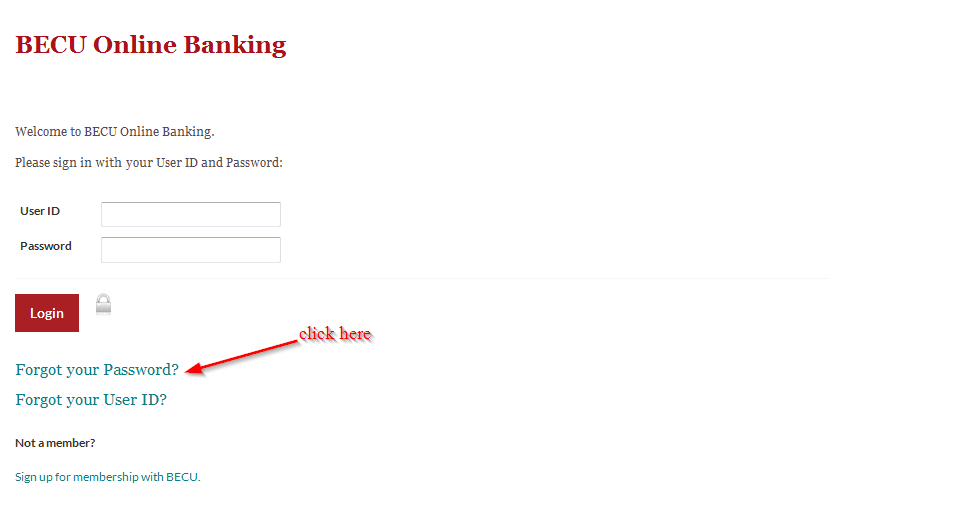

Step 1-Click “online banking” on the homepage

Step 2– Click “forgot your password?”

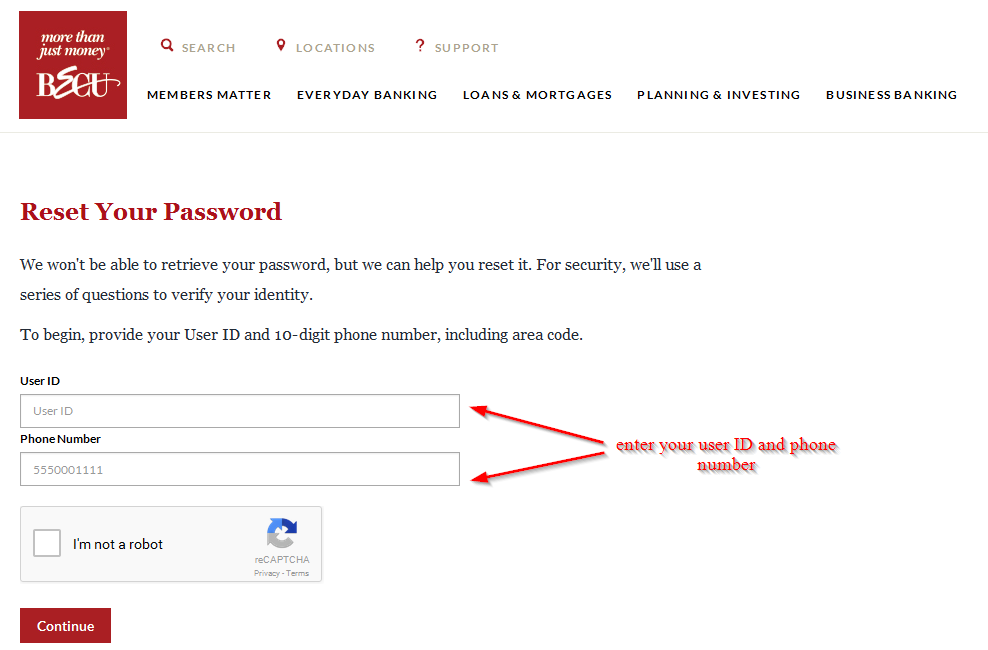

Step 3-Enter your user ID and phone number, check the small box to confirm you are not a robot and click “continue”

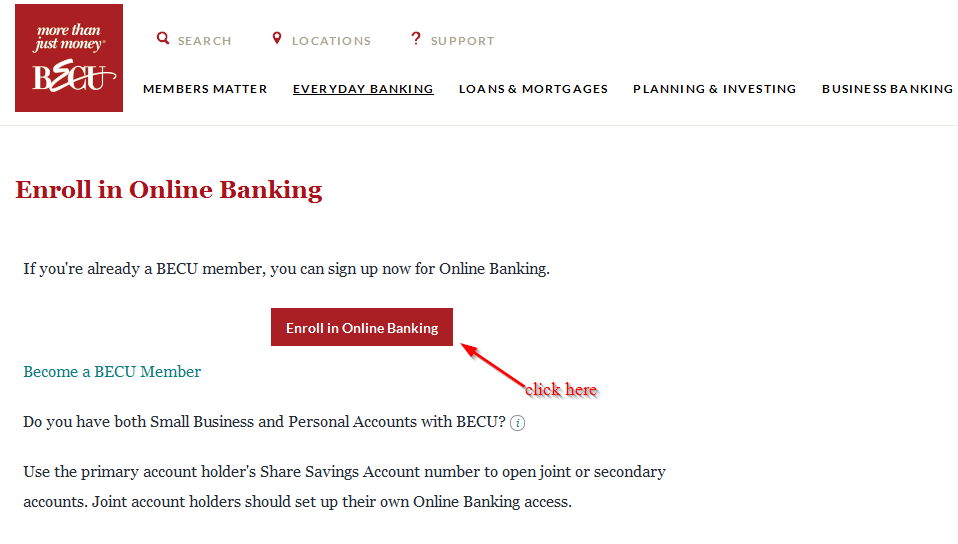

How to enroll

As we mentioned earlier on, it is free to register an online account with Boeing Employees Credit Union bank. You will be required to provide certain details about your bank account. Follow these steps to enroll:

Step 1-Again, click “online banking”

Step 2– Click “sign up for membership with BECU”

Step 3-Click “enroll in online banking”

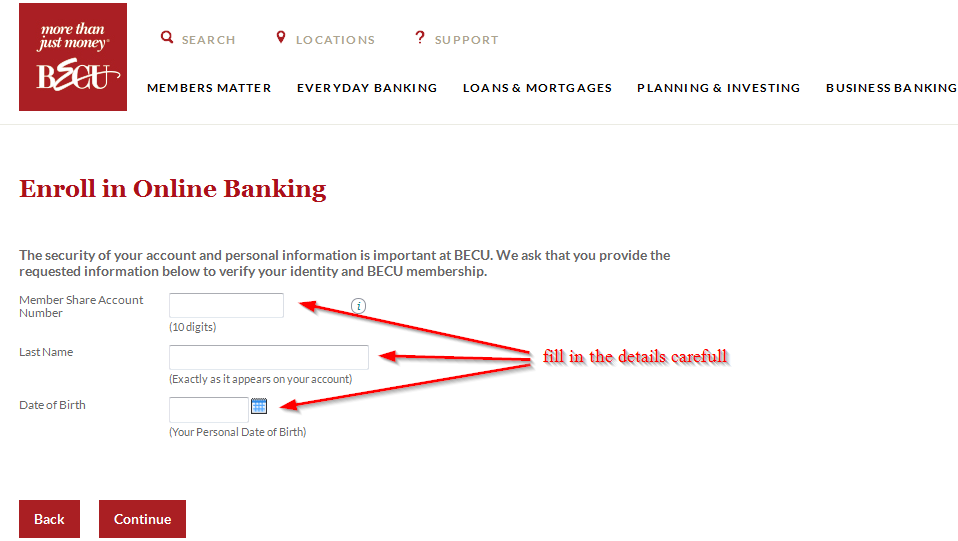

Step 3-Enter your member share account No., last name, and date of birth and click “continue”

Manage your Boeing Employees credit union online account

When you create an account with the bank, you will be able to do the following:

- Pay your bills via the internet

- Locate the nearest ATM

- Check your account balance by downloading your eStatement

- Apply for loans and mortgage

- Learn more about investment and investment

Boeing Employees Credit Union Review

Boeing Employees Credit Union was established in 1935. Today, the credit union is a member-owned, non-profit financial institution with over 925,000 members. With more than $12 billion in assets, Boeing Employees Credit Union is the largest credit union in Washington and 4th largest in the United States.

The company has more than forty five Neighborhood Financial Centers in the Pugeot Sound area and two branches in Spokane, Washington.

Anyone who owns a business, worships, lives or attends school in Washington is eligible to join Boeing Employees Credit Union as a current and past employee of Boeing, its affiliates or subsidiary, the Museum of Flight and BECU itself.

Checking accounts

Boeing Employees Credit Union checking account has a member advantage which basically pays 4.07% APY on the first 500 dollars. This is a short-lived advantage that falls to 0.05% APY after.

Customers are also required to agree to electronic services and one of these: transferring money between Boeing Employees Credit Union accounts, direct deposits and online bill payments. The main advantage of the checking account is lack of fees

Savings

Customers don’t have to worry about requirements or standard fees with Boeing Employees Credit Union savings account. With the credit union’s Money Management tool, customers can set savings goals and track expenses.

Benefits

Boeing Employees Credit Union is one of the largest credit unions as stated above. It has many benefits to its members. These benefits include:

- Extremely low APRs-Boeing Employees Credit Union offers rates that go as low as 2.09% for cars that are 2015 models or newer and as low as 2.69% for cars that are 2014 models or older. In addition, members get to receive similar low rate despite if you apply for car loans by yourself or through participating dealership.

- Earn a better rate automatically –BECU periodically evaluates its members’ credit rating while they have an existing car loan with them. If you have improved your credit score significantly and your auto loan is in good shape, you can earn a much better interest rate. The credit union will update your account automatically to your new lower APR and then notify you of the changes.

- Auto buying program-The credit union has gone into a partnership with AutoPREMIER Auto Buying Program in a move to provide its members with a service that connects them to a buying concierge that finds vehicles, connects members with dealers, negotiates prices and searches the vehicles history. The service is available to use and new vehicles.

- Terms up to eighty four months-If you are looking for lower monthly payments, Boeing Employees Credit Union offers car loans terms up to eighty four months. The company however has not revealed whether you need to have a certain credit score to get a longer loan term.

Downsides

Aside from being one of the largest credit unions in the United States, the company also has its own downsides, which you need to know. These disadvantages include:

- Bad credit loans-It is not clear whether Boeing Employees Credit Union accepts customers with bad credit or not. The credit union’s website doesn’t specify any credit score minimums and this makes it difficult for potential clients to have an idea whether it is would be best to apply for a loan with Boeing Employees Credit Union or not.

- Penalties and fees not disclosed-Boeing Employees Credit Union has not said whether it charges prepayment penalties or applications fees or not.

- Minimum refinancing information is available-The good thing is that Boeing Employees Credit Union offers refinancing options and has stated on its official website that this can save customers money if they qualify, even if the loan is with another bank. There is however no other information about refinancing that has been availed on the credit union’s website. That means that if this is something that you have developed interest in, you will need to contact the credit union to find out what you need to do so as to refinance your car loan.

Conclusion

Boeing Employees Credit Union offers its customers low APR and may even lower the APRs further if your credit ratings have improved since taking a loan. In addition, Boeing Employees Credit Union also offers loan terms up to eight four months and offers its members with a buying program that helps them to negotiate and find deals on cars.