Ally Bank provides personal and business banking services and products. Headquartered in Midvale, Utah, the bank operates a subsidiary of IB Finance Holding Company, LLC

- Branch / ATM Locator

- Website: https://www.ally.com/

- Routing Number: 124003116

- Swift Code: See Details

- Telephone Number: +1 877-247-2559

- Mobile App: Android | iPhone

- Founded: 2001 (23 years ago)

- Bank's Rating:

Ally Bank offers online banking services, which enable their customers to comfortably access their bank accounts and make payments, transfer money other accounts, access their eStatements etc. In this guide, we will be taking you through the process of logging into your online account, resetting your password and registering for the internet banking services.

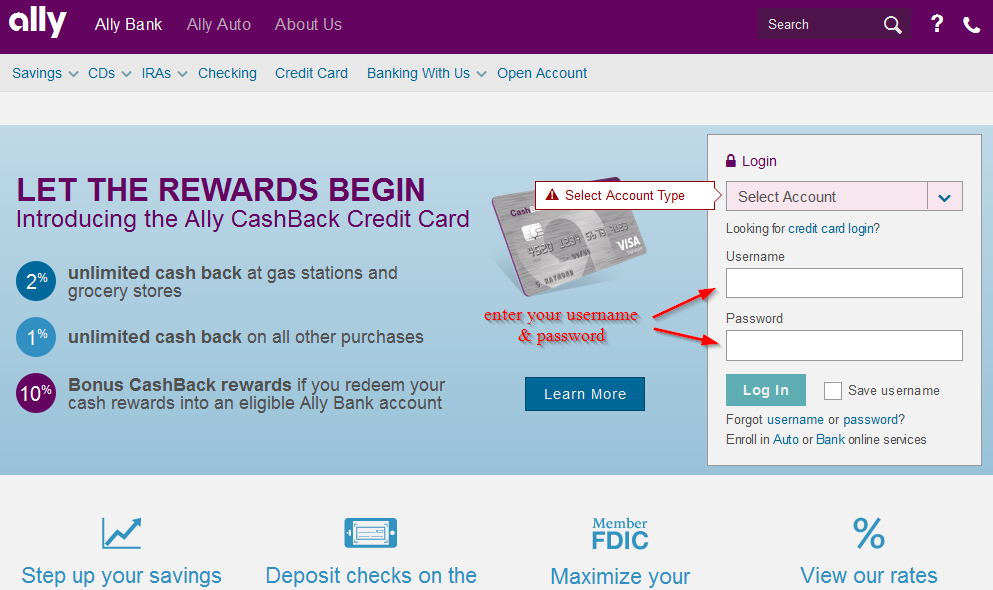

How to login

Accessing your online account is easy as long as you have registered an online account with the bank. The bank has an easy to use platform that enables customers to conveniently login into their online account. Here are the steps to login:

Step 1-Open your web browser and go to https://www.ally.com/

Step 2-Enter your username and password and click “login”

You will be directed into your online account if the logins you have used are correct

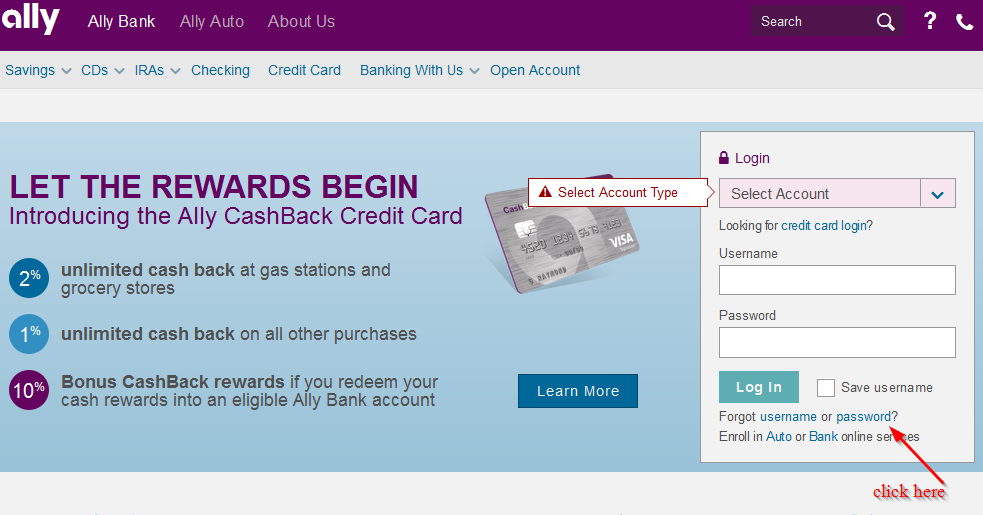

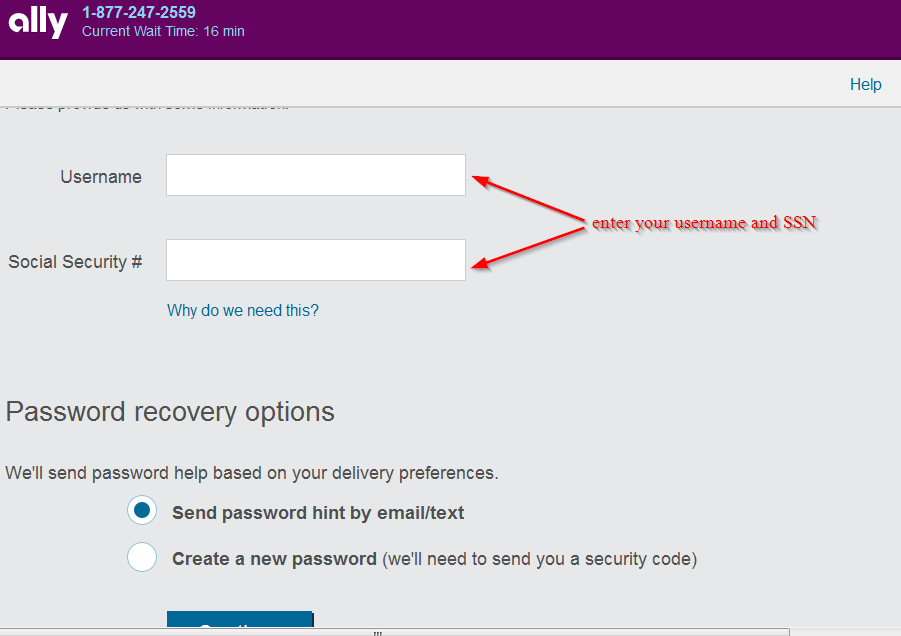

How to reset your password

Can’t remember your password? Don’t worry! It’s easy to reset your password. In these few steps, we will show you how to reset your password and access your online account again:

Step 1-Click “password” on the homepage as shown in the image below

Step 2– Enter your social security number and username and choose the password help option you want and click “continue”

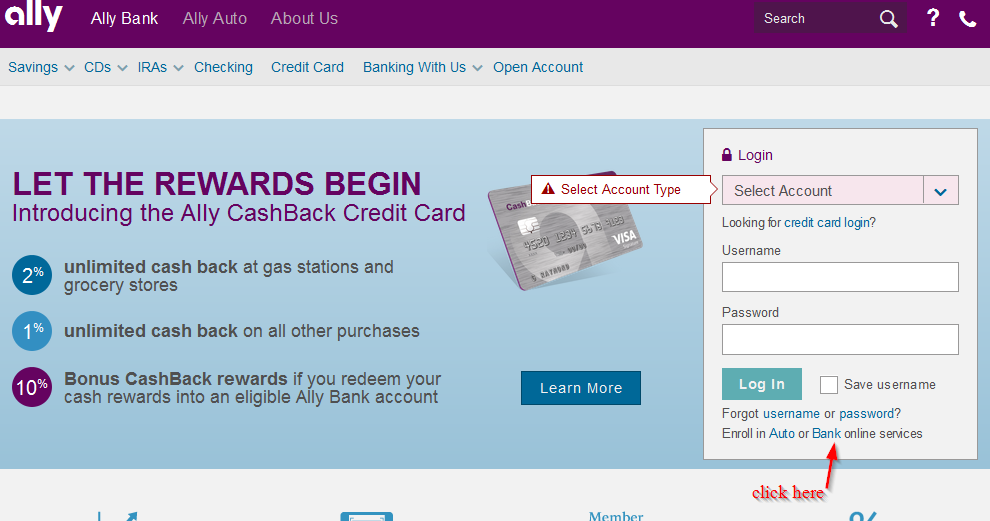

How to enroll

It’s easy to enroll for the internet banking services offered by the bank. These services are 100% and customers can login anytime and manage their bank accounts. Here are the steps you need to follow to successfully enroll:

Step 1-Click “bank” on the homepage. See the image below.

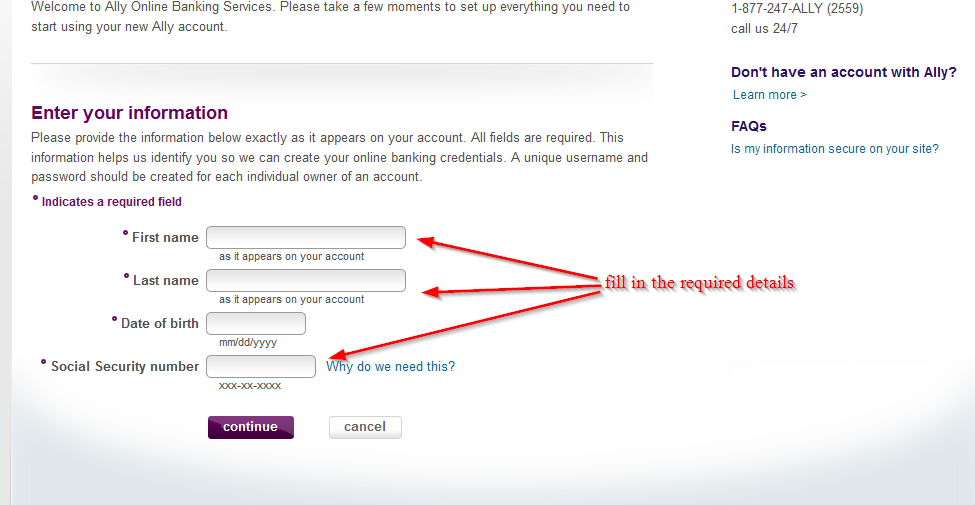

Step 2– Provide the information in the page as they appear on your bank account. Make sure that fill all the fields accurately. This information will help the bank to identify you so that they can create an online account for you. You will need to use a unique username and password for the account.

Manage your Ally Bank online account

Here are a few benefits of registering an online account with Ally Bank:

- Allows you to apply for loans

- Learn how to step up your savings

- Deposit checks

- Transfer money to other accounts

- Pay your bills

Ally Bank Review

Ally Bank was established in 1919 by General Motors Corporation as GMAC. Its goal was to provide financing to automotive customers. Today, the bank provides financial services, including corporate financing, mortgages, auto financing, stock brokerage, online banking and insurance.

Ally Bank is one of the leading auto lenders in the United States by volume and it is one of the largest banks in the U.S. The bank has $66B in retail customer deposits. It offers savings products including CDs, money market accounts, interest checking accounts, credit cards and mortgages.

The bank has mixed reviews. The internet specifically has some nice reviews for Ally Bank, but it also has some negative reviews

One of the main attractions of this bank is the APY that it pays on deposit products. To access the latest rates, you will want to visit the bank’s website as the rates often change. The bank usually checks its customer’s credit even though they may not intent to get a loan.

The main reason being they want to verify your identity and try to figure out if you will be able to use your overdraft protection plan in a responsible way. If the bank finds that you have good credit or you have a bad financial history, it may cause anxiety.

Interest checking

The bank has an interest checking account that makes it easy for you to earn some money while keeping it liquid. Its interest banking checking account doesn’t have limits on withdrawals from the account. If you are not familiar with the bank’s interest checking account, you may want to learn the basics on its website.

You will also receive free checks from the bank and it allows you reorder basic checks at no fee. This differentiates it from other banks which charge its customers for check reorders. In addition, there is no monthly fee and minimum deposit at Ally Bank, thus making it more attractive.

Customers also get to enjoy free online Bill Pay and they get a debit card for purchases and ATM withdrawals.

Certificate of Deposit accounts

Ally Bank offers amazing rates on CD accounts, and various options. The bank’s ‘no penalty’ CD makes it easy for customers to take money out early without any fees paid. High-yield CD pays more, however it has tradition Certificate of Deposit penalties if you choose to cash-out before maturity.

Deposit accounts

Ally Bank offers money market and savings accounts. The primary difference is that money market account usually includes a debit card. You need to keep in mind the fact that the bank only accepts 6 withdrawals per month from these accounts.

If your goal is to get some interest then you will want to choose a savings account. Although you will have limited access, the APY will certainly be the highest. The bank’s money market account is not as lucrative as savings; however, it is easier to withdraw funds if you want to do so.

Customers are provided with a debit card that they can use a number of times a month. Lastly, the interest checking account allows customers to spend less or more freely and pay their bills online

Benefits

When Ally Bank started providing banking services, they had a controversial advertising campaign. Seems like its goal was to bash banks and stand out as a friendlier and different kind of bank in the United States. The bank also used TV ads that reportedly disturbed viewers.

- Transparent fee structure

- More than 43,000 fee-free ATMs

- A $10 repayment for other ATM fees

- Easy-to-use website and mobile apps

- No minimum account balance and monthly maintenance fees

- Around the clock customer support

- Fee transfers to external accounts

Downsides

Aside from being one of the best and oldest banks in the United States, it also has downsides that customers should know about. The disadvantages include:

- No in-person banking

- You cannot deposit money into your accounts

- Number of financial products is limited

- Doesn’t offer much financial advising for difficult situations

Conclusion

Ally Bank offers competitive interest rates on savings and checking accounts in addition to unlimited ATM reimbursements. It goes without saying that the most reliable online-only banks that you can choose.