Fifth Third Bank was founded in 1858 and is a member of FDIC. The bank listens to new ideas to strengthen its commitment to their customers.

- Branch / ATM Locator

- Website: https://www.53.com/

- Routing Number: 063109935

- Swift Code: See Details

- Telephone Number: +1 800-972-3030

- Mobile App: Android | iPhone

- Founded: 1858 (166 years ago)

- Bank's Rating:

Fifth third bank offers internet banking services, which allow customers to manage the activities of their bank accounts. These services are completely free and customers can login into their online account anytime. In this comprehensive guide, we will walk you through a step by step process on how you can login into your online account, how you can reset your password and how you can enroll for the online banking services offered.

How to login

To login, you must have already registered an online account with the bank. The process is pretty simple and straight forward. You will need your login details to access the online account. Follow these simple steps to login:

Step 1-Open https://www.53.com/ in your web browser

Step 2-Click “login”

Step 3-Enter your user ID and password and click “log in”

You will be granted access to your online account if you user valid logins

Forgot your password?

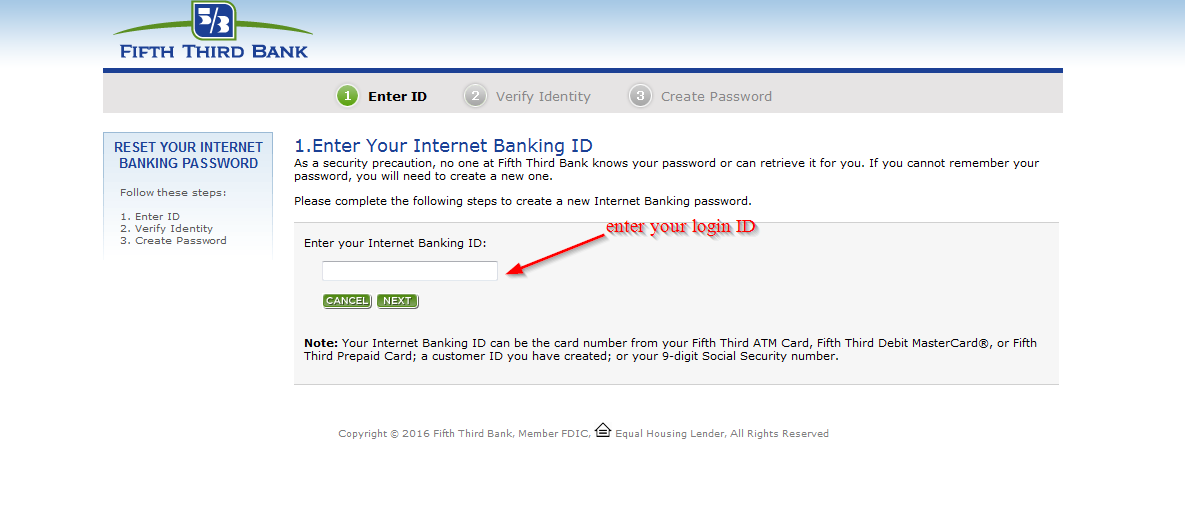

Failure to use the correct password means that you won’t be able to access your online account. You can reset your password as long as you have the correct username. Here are the steps you’ll be required to follow:

Step 1-Go to the Homepage and click “log in”

Step 2-Click “forget user ID or password”

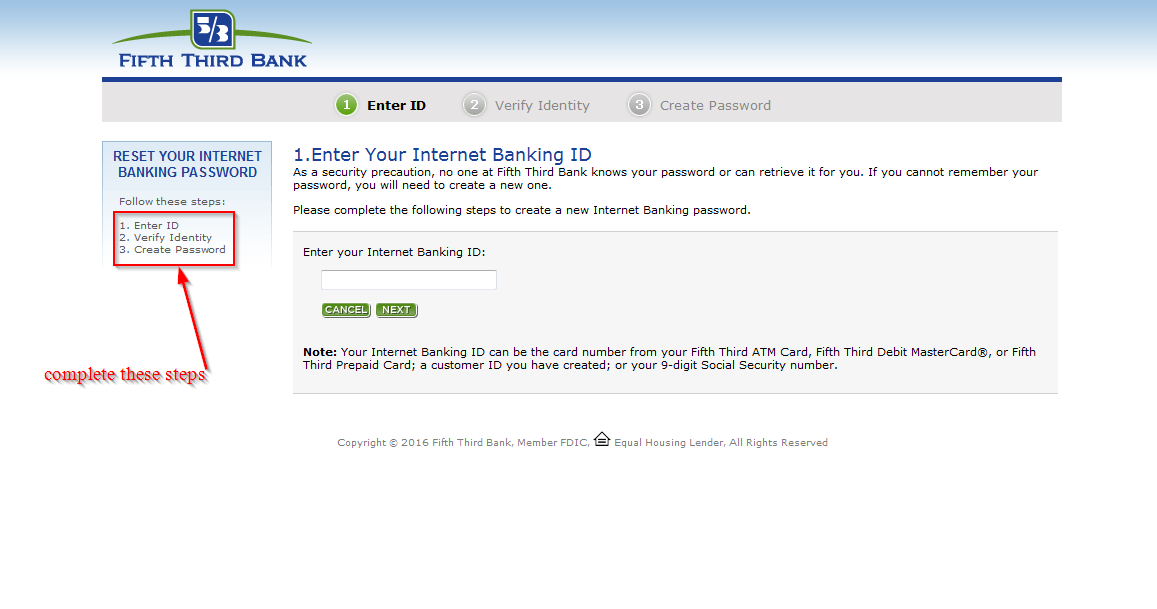

Step 3-Enter your internet banking ID and click “next”

Step 4-Complete two more steps: verify identity and create password

How to enroll

The good news about registering an online account with Fifth Third Bank is that it only takes a few minutes. These services are however only available for customers who have an account with the bank. Here are the steps you can follow:

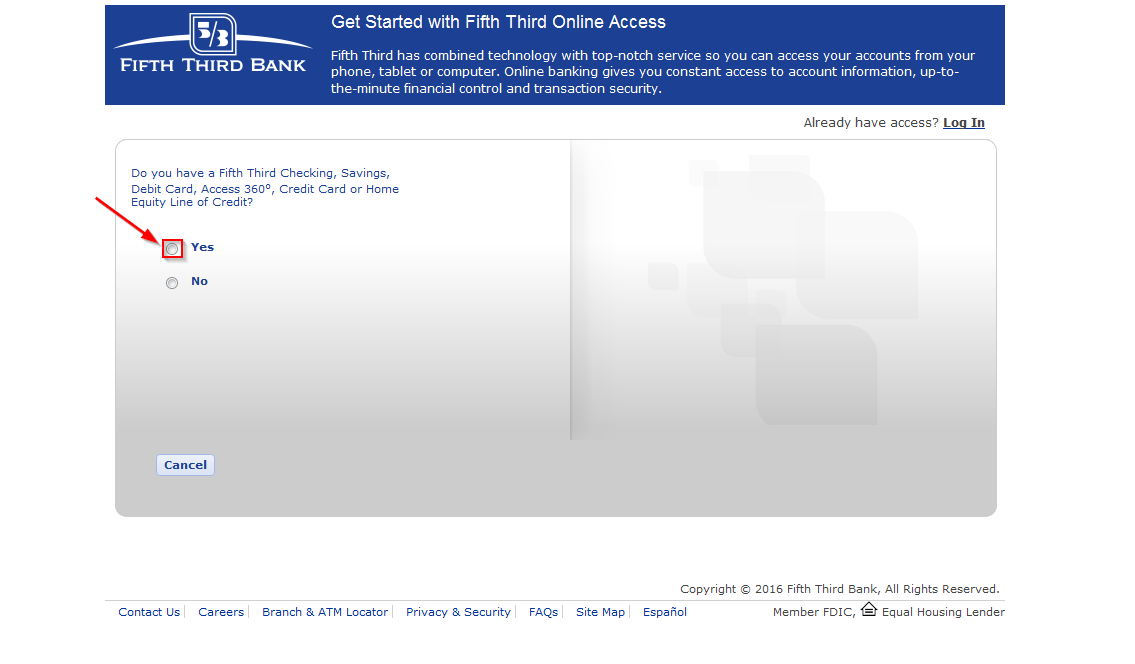

Step 1-Again, start on the Homepage and click “login”

Step 2-Click “register”

Step 3-Click yes if you have a have a Fifth Third Checking, Savings, Debit Card, Access 360o, Credit Card or Home Equity Line of Credit

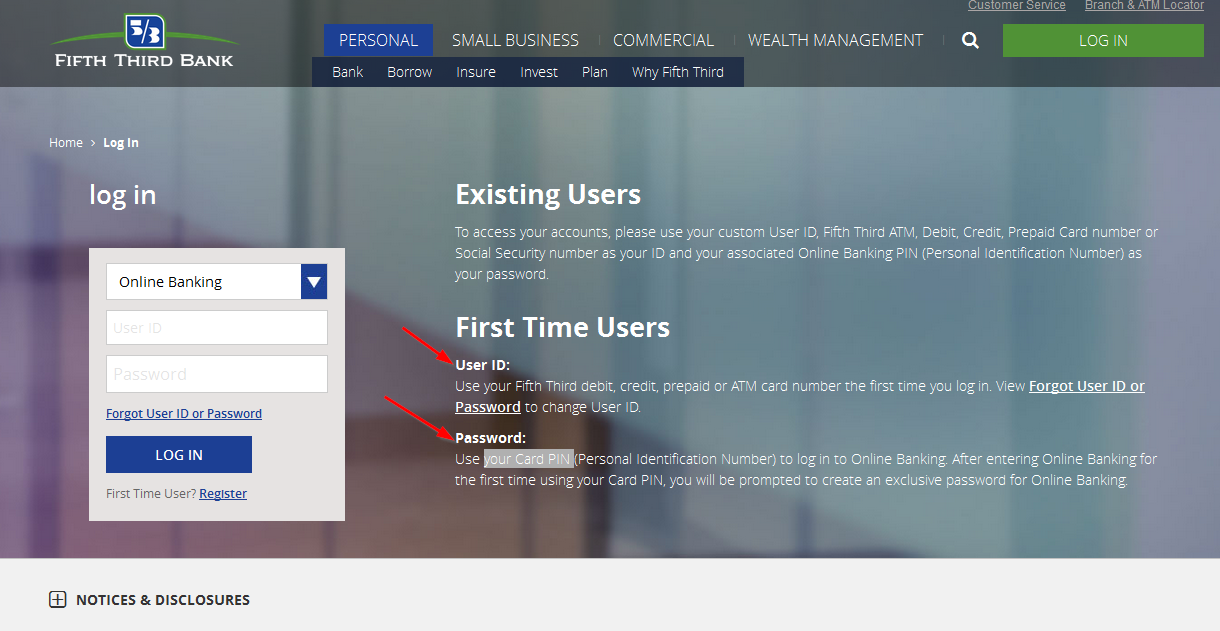

Step 4-Use your Fifth Third debit, credit, prepaid or ATM card number as user ID for first time you log in and your Card PIN and password

Manage your Fifth Third Bank online account

As mentioned earlier on, registering for the online banking services offered by the bank is completely free. Here are the advantages of registering a free online account with the bank:

- It’s easy to make payments anytime

- You can check your account balances

- Apply for loans

- Locate an ATM near you

- Online customer service

Fifth Third Bank Review

The Fifth Third Bank is a United States regional financial services company based in Cincinnati, Ohio and is the main subsidiary of Fifth Third Bancorp.

The bank operates in the following states: North Carolina, Ohio, Indiana, Illinois, Kentucky, Michigan, Tennessee and Georgia. They have a network of more than 2,600 ATMs and over 1,250 full-service branches. The bank also provides financial options to those who want to buy homes, further their education and looking for retirement options.

Benefits

The bank offers tradition banking services: savings accounts, checking accounts, debit cards and lending options. In addition, they offer online and mobile banking services to consumers and varying draft solutions. There are also preferred options for additional interest benefits.

Checking accounts

The bank has seven varying account options and six different account options. Each account comes with its own benefits. Although there are different limitations, restrictions and benefits to each account, most likely there will be the ideal account for anyone who decides to bank Fifth Third Bank. Here is a breakdown of the accounts:

- Essential checking: Enjoy all the essentials of a checking account and many ways to avoid the monthly service fee, which can be waived.

- Enhanced checking: Earn some interest on your checking account and take advantage of enhanced benefits and discounts. The monthly service fee can be waived.

- Preferred checking: When you join this exclusive program, you will get a higher interest on your checking account and enjoy preferred services, benefits and discounts. No monthly fee is charged

- Student banking: This is a personal checking account that receives the same amazing benefits as the Essential Checking, but the monthly service fee is waived for High School and College students who are 16 years and more. No minimum balance requirements and no monthly service fee

- Military banking: This type of account is meant for military families, including retired, veterans, active duty and reserved/guard. It also includes commissioned offices of the National Oceanic and Atmospheric Administration and the Public Health Service.

- Express banking: This account offers a simple way to manage your finances. It gives you immediate access to your funds

Savings accounts

- Fifth Third bank savings accounts include goal getter savings, relationship savings, relationship money market, 529 Savings and CD, minor savings, health savings accounts and certificate deposit.

Downsides

- Limited credit cards

Getting a credit card through the bank is basically one of the best-managed and easiest solutions available to customers. Although Fifth Third Bank offers credit options to individuals and small business owners, there are four different types of card to choose from. One thing that is definitely missing from the group is the credit card designated for students. The credit card options offer by Fifth Third Bank include:

- Platinum Card: This is the bank’s lowest rate credit card together with platinum-level benefits

- Real Life Rewards Credit Card: Get 2 Real Life Reward points for every one dollar spent on grocery and store. Get 1 point for every one dollar spent on all other purchases. A zero percent Introductory APR applies on Balance Transfers and Purchases for the first twelve billing cycles after the opening of the account. Based on creditworthiness, the APR is usually 13.24% to 24.24% after the Introductory Period. After opening an account, the APR will fluctuate with the market based on WSJ Prime rate.

- Preferred Card: This premium credit card is meant to meet the needs of consumers by combining great benefits and exceptional service

- Cash Rewards Card: You can win unlimited Cash Bank in addition to 10,000 Real Life Reward Points when you make purchases worth $1,000 within 90 days of opening an account.

Wealth investing and management

There are wealth investing and management opportunities for those who are interested through the bank’s platform. The solutions include: estate planning, retirement strategies, and diversified investment options. However, to get started with these investment solutions, you will be required to visit a branch and speak to an advisor.

Conclusion

For small businesses that want a loan or individuals who are looking for personal investing options, Fifth Third Bank has solutions for you. The bank has found a way to make banking straightforward and simple, thus eliminating some of the vagueness or confusion that sometimes exists in the industry.