First Premier Bank is a community bank that provides financial services to customers, businesses, agricultural producers and organization in United States. The bank operates as a subsidiary of United Nation Corporation.

- Branch / ATM Locator

- Website: https://firstpremier.com/

- Routing Number:

- Swift Code: 091408598

- Telephone Number: 800-987-5521

- Mobile App: Android | iPhone

- Founded: 1914 (110 years ago)

- Bank's Rating:

First Premier Banks gives their customers access to their bank accounts through their internet banking services. People who have an account with the bank can conveniently login anytime and manage their bank account activities. Here is a guide to help you login into your First Premier Bank online account, reset your password and register for the internet banking services.

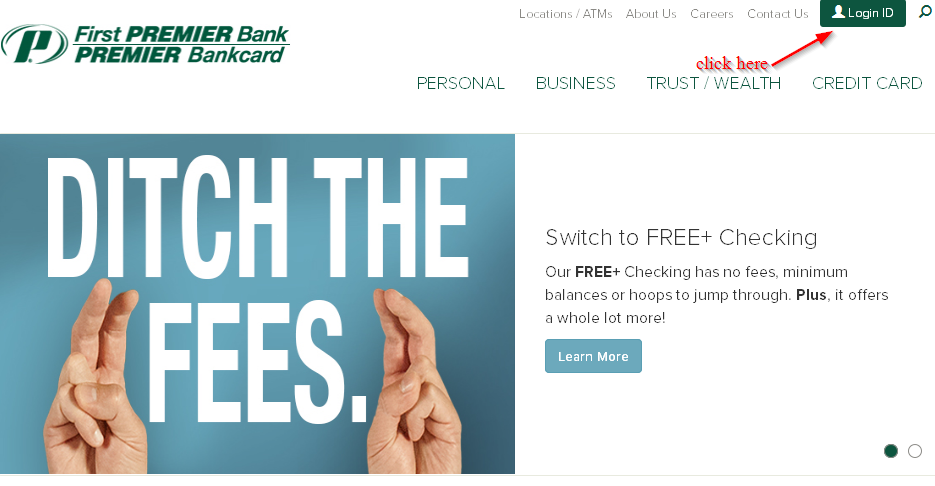

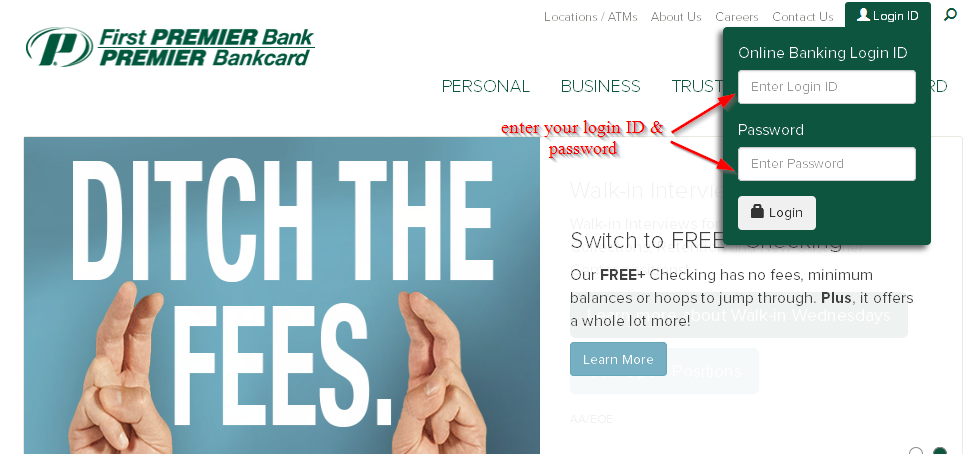

How to login

If you have already enrolled for the internet banking services, you can login anytime and access your bank account. You will need your login ID and password to login. Follow these simple steps to access your online account:

Step 1-Open https://firstpremier.com/ in your web browser

Step 2-Click “login ID”

Step 3-Enter your login ID and password and click “login”

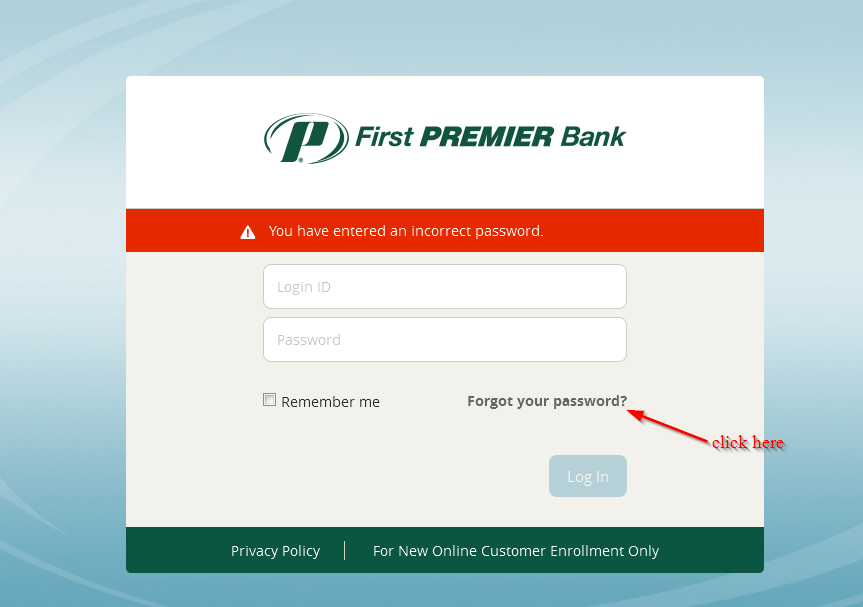

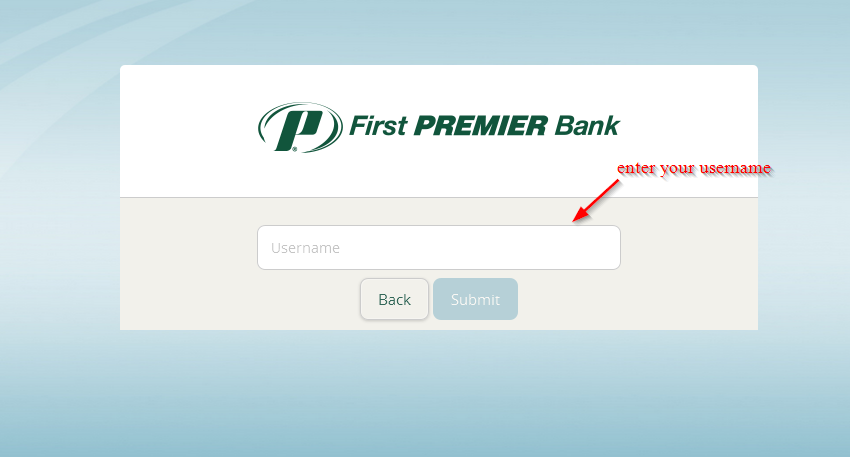

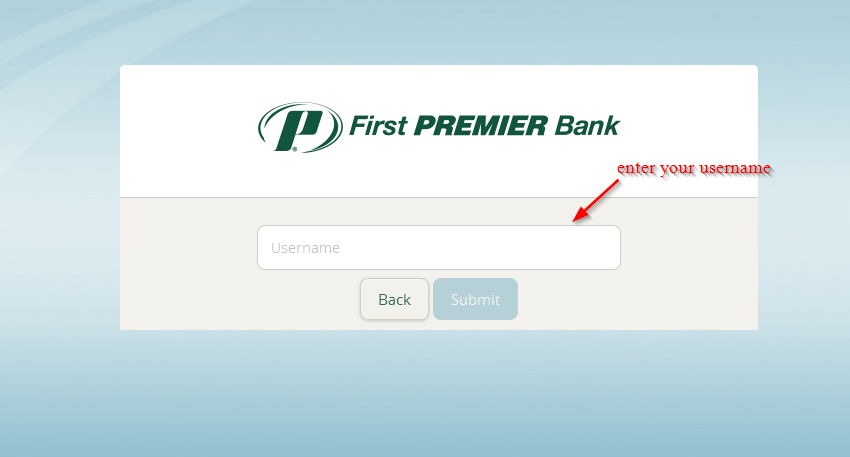

Forgot your password?

If you can login into your online account because you have forgotten your password, you can reset it provided you have a valid login ID. You can reset your password in these simple steps:

Step 1-Again, enter your login ID and password and click “login”

Step 2-Click “forgot your password?”

Step 3-Enter your user ID and click “submit”

The bank will send a new password to your email address

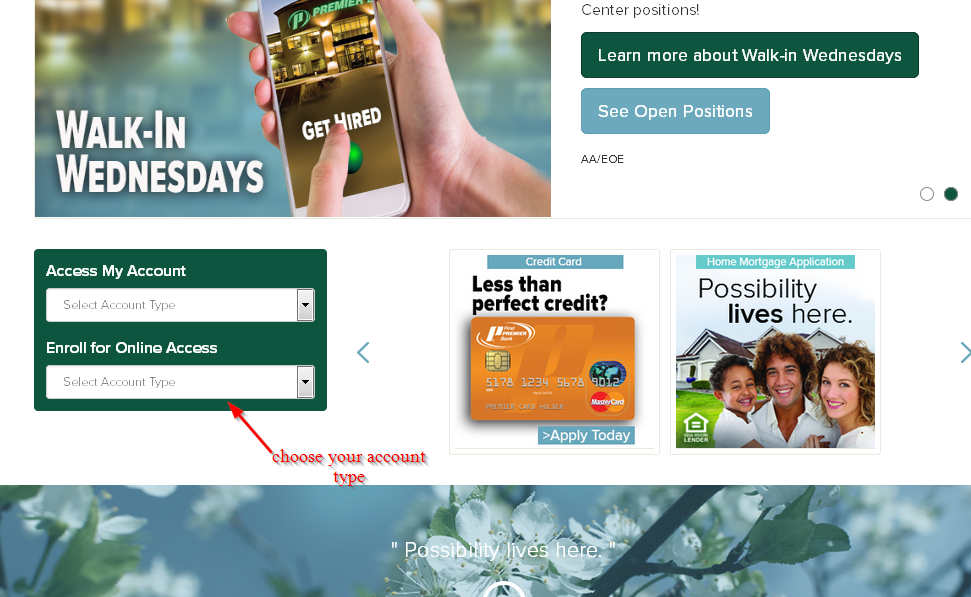

How to enroll

If you have an account with First Premier Bank, you can enroll for the online banking services in less than 5 minutes. It’s pretty straight forward-just like setting up any online account. Follow these steps to enroll for the online banking services:

Step 1-Choose your account type by clicking the roll down menu

Step 2-Carefully fill in the details required (account type, account number, date of birth, social security number, and requested login ID, and click “continue”

By providing all the information required and clicking “continue,” you will have registered for the internet banking services offered by First Premier Bank

Manage your First Premier Bank online account

When you register an online account with First Premier Bank, you will not only take the advantage of using a safe and secure platform but also enjoy the following benefits:

- You can pay your bills anytime

- Make payments

- Access your eStatements

- Check your transaction history

First Premier Bank Review

First Premier Bank is based in Sioux Falls, South Dakota and it is the 10th largest issuer of MasterCard credit cards in the U.S. The bank specializes in a range of subprime credit cards that are usually marketed to people who have less than perfect credit.

In October 2010, First Premier Bank was cited for providing the worst credit card by the Comers Union in the nation. According to the group, the bank charged up to 59% interest on credit cards that are limited to $300. The credit cards are using the names First Premier as well as Centennial and Aventium.

Rebuilding or establishing your credit can be challenging if devalue your banking choices to mainstream the lenders.

You may increase your chances of opening your lines of credit and rising your credit score by selecting a lender that focuses on helping high-risk customers to secure financing. We have covered here a few points that will help you determine if First Premier Bank is the right bank for you.

Benefits

First Premier Bank was established in 1986 by businessman Thomas Denny Sanford. The bank has an A+ rating in the Better Business Bureau and has been commended by leaders in the lending and high-risk credit industry for its availability of banking services all types of customers.

- The bank also received praise for independent review sites for offering customers a fair line of credit to help them institute responsible purchasing and payment traits.

- Customers have the chance to increase their lines of credit provide they make payments on time and express responsible borrowing behavior. A significant number of customers are usually given an increase of 100 to 200 dollars after using their credit cards for one year responsibly.

- Likewise, First Premier Bank makes its banking services available to a wide range of clients, from college and university students just starting out in life to the elderly who have already retired and are looking to build a posit credit rating.

- The bank targets customer that are rebuilding their credit after divorce or bankruptcy.

- The approval process for First Premier Bank finance and credit services is likely to be faster and more lenient than the approval process used by other high end creditors and financial institutions.

- In addition, customers can apply for credit and easily manage their bank accounts and credit cards online from the bank’s website.

Downsides

Despite the bank’s effort in helping people to rebuild their credit and learn some basic borrowing and payment traits, it has received some criticism from certain independent review websites where reviewers have noted that the bank charge a high interest rate on principle line of credit the bank offers to its customers.

In fact, some customer are charged an APR that is as high as 36%.

- In addition, First Premier Bank offers charges its customers a one-time fee of $95 to open an account. That amount is usually taken out of the initial line of credit, hence putting customers in debt without having purchase something.

- First Premier Bank also received negative feedback for its annual fees. These fees can range from between $75 and $125 for the first year and for every subsequent year that you maintain your card; you will be required to pay between $45 and $49.

- In addition, First Premier Bank charges its customers a monthly maintenance fee of 6.95 for their accounts.

- When these fees are combined with the high interest rate, it can lead to financial distress that could put the customer behind their payments, and at the end of the day, they will have little actual credit to make purchases.

- A bigger percentage of the money that they pay goes towards the fees and interest instead of the actual principle. It usually takes customers longer to pay back what they owe the bank.

- The bank also received less than positive reviews for its controversial collection practices. Clients have said that First Premier Bank agents will call them at work rather than at home. In addition, they call past the set legal time frame for making the collection calls.

Conclusion

First Premier Bank has been fully operational for the last 30 years and has offered high-risk borrows and opportunity to rebuild their credit and borrow money. You can make a solid decision whether its banking and lending services are good for you by considering the above points.