Hancock Whitney bank offers personal and business banking services. The bank was formerly known as Hancock Bank of Louisiana. It was founded in 1899 and is based in Baton Rouge, Louisiana.

- Branch / ATM Locator

- Website: https://www.hancockwhitney.com/

- Routing Number: . 061000146

- Swift Code: See Details

- Telephone Number: 1-800-448-8812

- Mobile App: Android | iPhone

- Founded: 1899 (126 years ago)

- Bank's Rating:

Hancock Whitney Bank’s internet banking services are convenient and make it easy for customers to conveniently manage their bank accounts, whether personal and business. The bank has a good reputation in giving its customers the best banking experience, and with its internet banking services, it will be a lot easy for customers to manage their bank accounts. Here is a guide to help you login into your account, retrieve your password in case you forgot and register a free account.

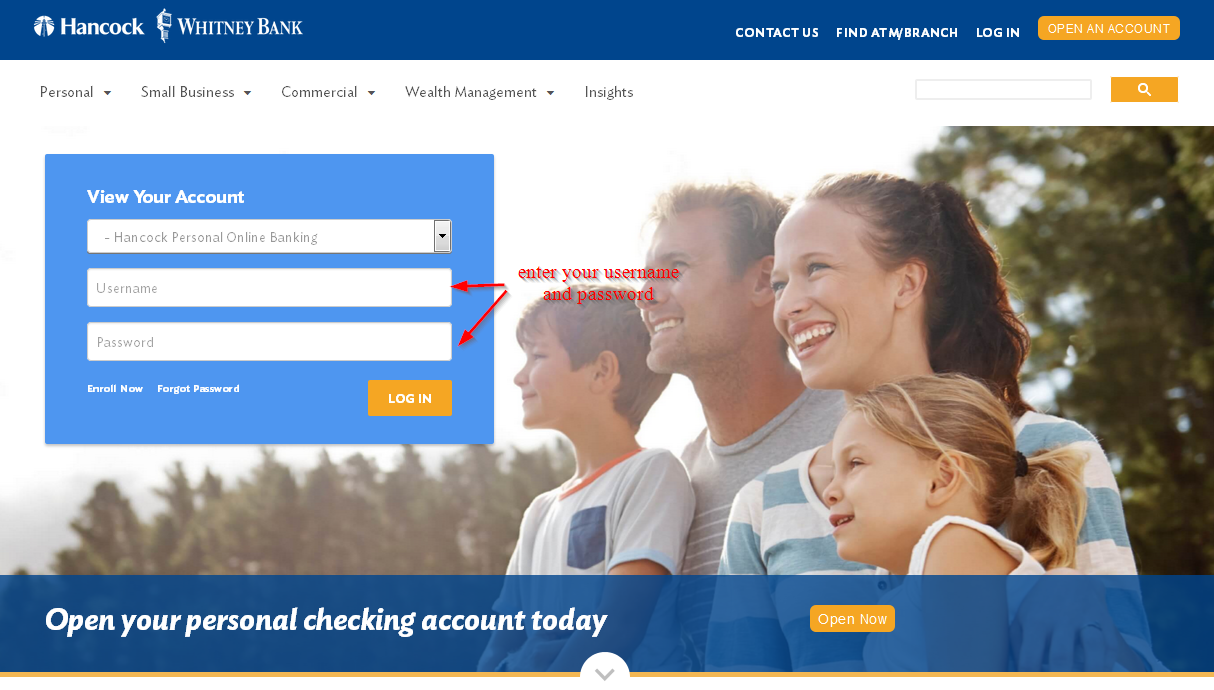

How to login

Hancock Whitney Bank has an easy to use interface that enables its customers to conveniently login into their online accounts and bank anytime. In this case, you will need your user ID and password to login. Here are a few steps to help you login:

Step 1-Open https://www.hancockwhitney.com/ in your web browser

Step 2– Choose your account type and enter your username and password and click “login”

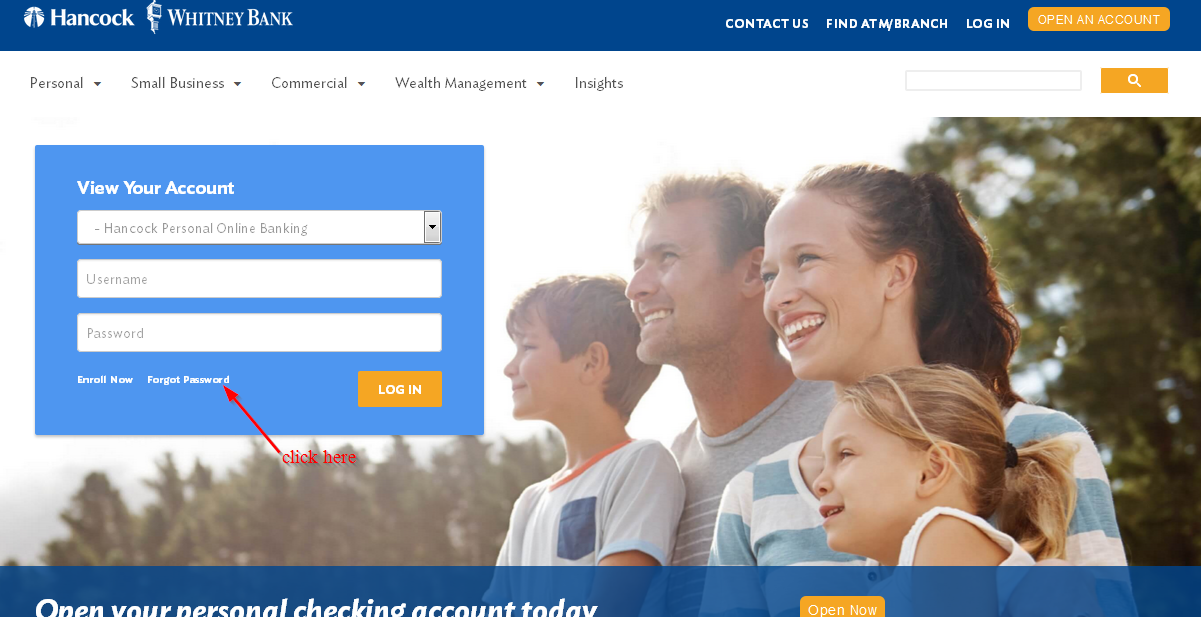

Forgot your password?

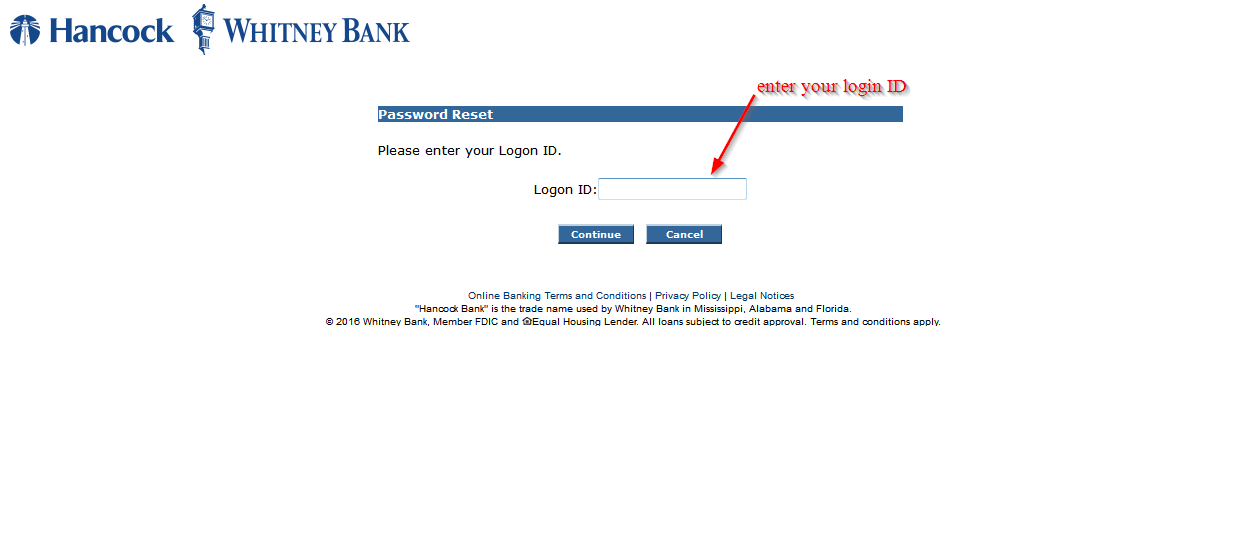

In case you forgot your password, you can reset it anytime to regain access to your online account. The process of resetting the password is pretty simple since it only takes a few minutes. Reset your password in these simple steps:

Step 1-Go to the homepage and click “login”

Step 2-Click “forgot password?”

Step 3-Enter the last ID and click “continue”

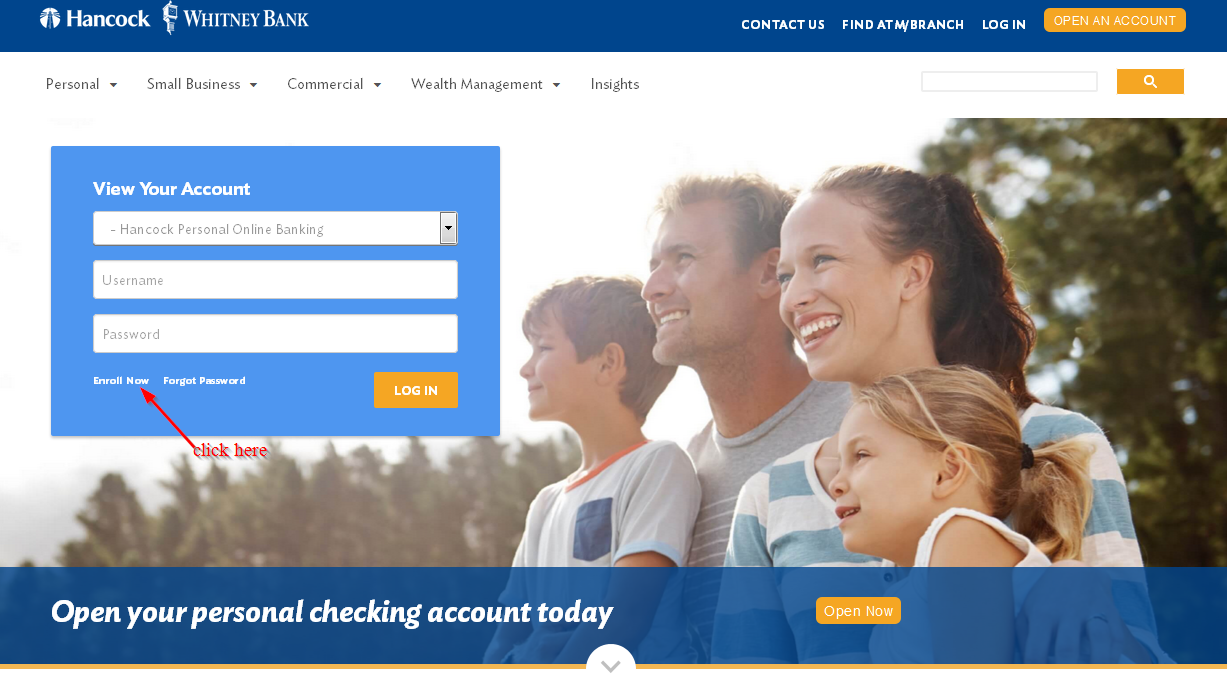

How to enroll

You can enroll to the internet banking services anytime provided you are a customer with the bank. During the enrollment process, you will be required to provide certain details about your bank account that will verify that you indeed have an account with the bank. Here are steps to enroll:

Step 1-Again, go to the homepage and click “login”

Step 2-Click “enroll in online banking”

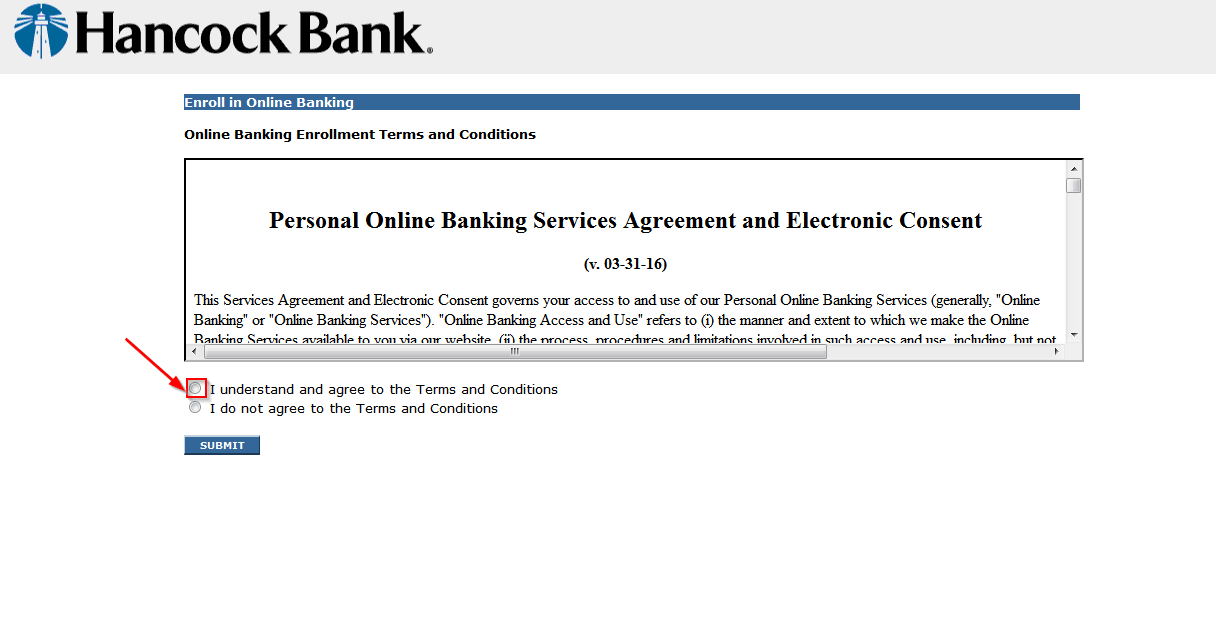

Step 3-Read the terms and conditions and check the box to confirm that you agree and then click “submit”

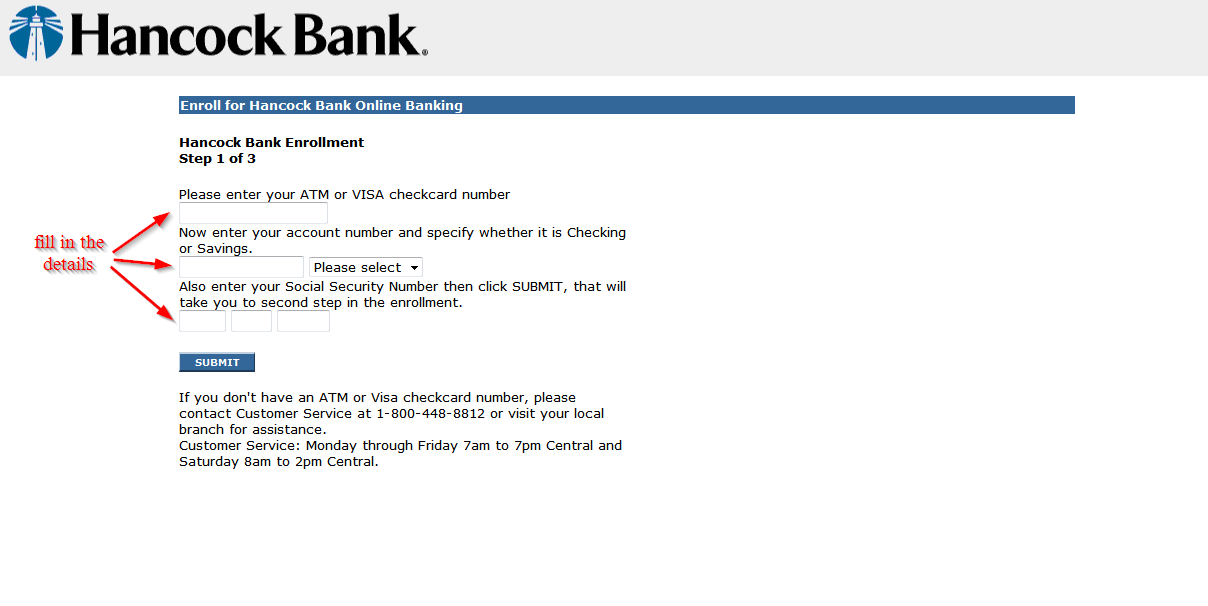

Step 4-Fill in all the details accurately

Manage your Hancock Whitney Bank online account

Here are the advantages of having an online account with Hancock Whitney Bank

- Pay your bills conveniently

- Transfer money a friends account or any other account

- Track your transaction history

- Find the nearest ATM location

Hancock Whitney Bank Review

Hancock Bank acquired New Orleans-based Whitney National Bank in December 2010 in a stock-for-stock transaction. The merger has significantly expanded Hancock Bank’s presence in Texas and Florida.

Stock holders for Whitney receive shares of the Hancock stock and 5 Whitney board members joined the board of Hancock Holding Company. The merger resulted into an entity that has about $20 billion assets, $12 billion in loans, $16 billion in deposits, 390 ATMs, 305 branches and more than 5,000 employees.

Following the merger, Hancock Bank had to pay back the TARP debt that was owed by Whitney Bank. Whitney also added an international market for the new company.

Hancock Whitney Bank offers a number of banking options that you obviously need to know about so that you can make an informed decision.

Checking accounts

Hancock Whitney Bank has straightforward checking account that allow its customers to bank how, when and where they want. Customers can use checking accounts to pay bills, maintain their lifestyles and cover everyday expenses.

Hancock Whitney Bank personal checking account helps you to keep your hard-earned money safe and also easy to access. Personal checking options include:

- Access checking-This account gives you all the must-have features and tools to manage and access fund, where, where and how you want

- Connect checking-This is more than just any checking account. Easy access and premium security benefits gives you peace of mind

- Priority checking-This is an interest-earning account meant to maximize your earnings as well as offer other priority services for more complex financial needs.

Features of Hancock Whitney Bank checking accounts include:

- ATMs and branches across Fl, AL, TX, LA and MS

- Helpful service from Monday to Saturday by phone or email

- Online banking and bill pay with secure eStatements

- Access to Visa Debit Card with ApplePay

Saving account

If you want t make some special purchase, start good financial habits, or build up your emergency funds, then Hancock Whitney Bank has a range of products to help you achieve the goal

- Silver savings-This is the perfect account for anyone who is looking for easy access to their money. Low risk and steady return make this savings account a good option for preparing for the unexpected or future purchases

- Christmas club savings-This account helps you to save for holiday seasons by setting aside money throughout the year just for holiday expenses

- Money market-This account offers competitive rates in a setting that’s low risk one. The more money you save, the more you earn. That means that it pays when you maintain higher balances. What sets this savings account apart is the ability to directly write checks from your money market account, thus providing easy access to your money without transfers

- Relationship rewards money market-This account offers all the benefits of a money market account, but higher minimum balance and you can get even higher yields on premium interest rates.

- Certificate of deposit-This account helps you to save for your short term and long term goals. It has guaranteed fixed rate returns.

- Individual retirement accounts-Also known as IRA’s, these are one of the best ways to create your retirement nest egg and are the best for receiving required minimum distributions

Benefits

Hancock Whitney Bank has its own benefits that make it an outstanding bank. These benefits include:

- Convenient online and mobile banking

- Convenient across to branches and ATMs in their area of service, with more branches per state when compare to most national financial institutions

- Excellent customer service

- Access to Visa Debit Card with ApplePay

- Affordability rating of 4 out of 5 stars on home equity lines of credit

- Low fees that its competitors

Downsides

Hancock Whitney Bank has its downsides which you should be aware of before banking with the bank:

- Based on its account interest rates, fees and size, the bank only gets a smart rating of 93 out of 100, which is lower than the national average of 94

- The bank also has a lower APY

Conclusion

Hancock Whitney Bank is one of the most trusted banks in the United States. It is known for its excellent customer service and lower fees than its competitors, but it has a lower APY and interest rates are also lower.