Prosperity Bank provides banking products and services to individuals and businesses in Texas and Oklahoma. The company was founded in 1943 and it operates as a subsidiary of Prosperity Holdings of Delaware, LLC.

- Branch / ATM Locator

- Website: https://www.prosperitybankusa.com/

- Routing Number: 113122655

- Swift Code: See Details

- Telephone Number: 1-800-684-2132

- Mobile App: Android | iPhone

- Founded: 1983 (41 years ago)

- Bank's Rating:

Prosperity Bank has made it easy for their customers to conveniently manage their bank accounts. The bank has embraced technology, and through its safe and secure online platform, customers are able to make payments, check their account balances, track transaction history etc. If you are interested, we will take you through a step by step guide on how you can login, reset your password and register for the internet banking services.

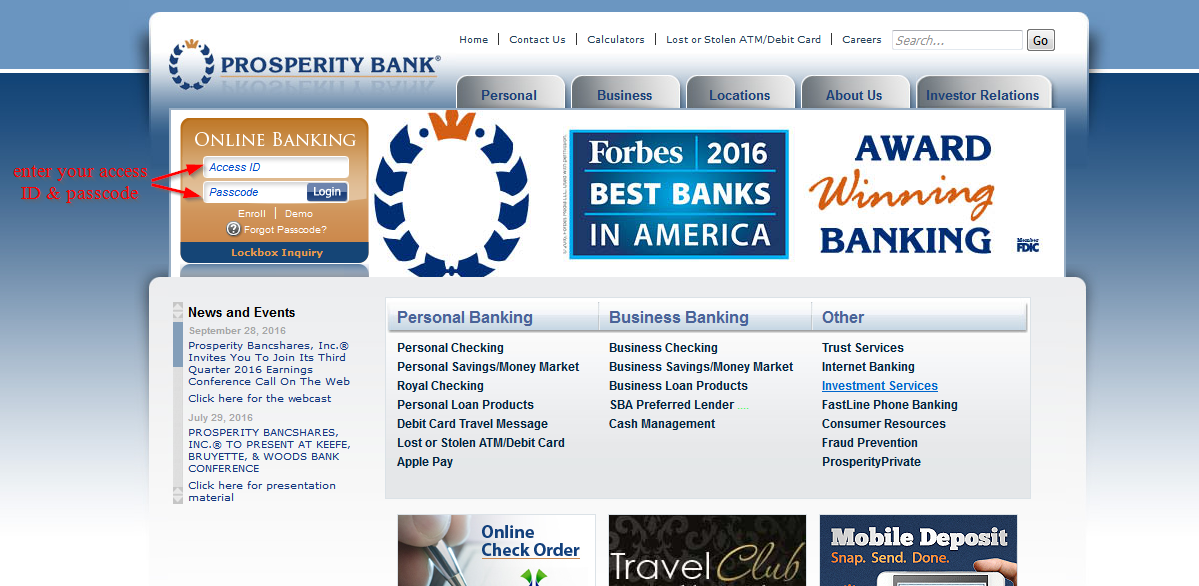

How to login

Prosperity Bank has an easy to use platform that customers can conveniently login anytime and bank from the comfort of their homes or anywhere around the world. Follow this simple step by step guide to login:

Step 1-Open https://www.prosperitybankusa.com/ in your web browser

Step 2-Enter your username and password and click “login”

If you have used the correct username and password are correct, you will be directed to your account

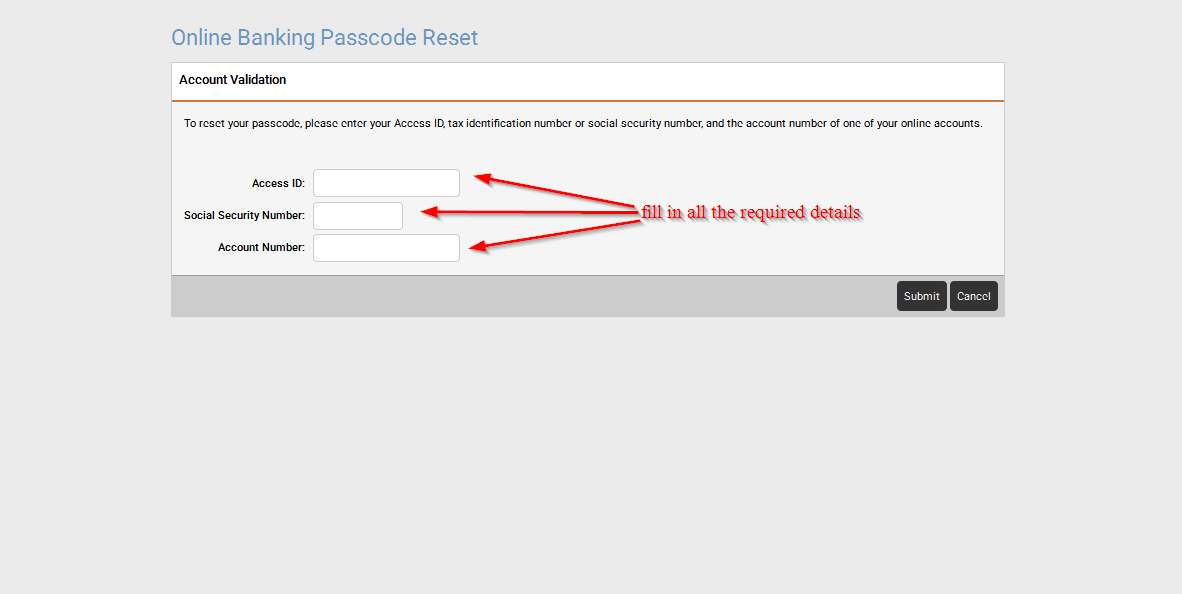

How to reset your password

In case you have forgotten, or you want to reset it for security purpose, you will need to use a valid user ID. Follow this step by step guide to reset your password:

Step 1-Click “forgot passcode” as show in the below image

Step 2-Enter your access ID, social security number and your account number and click “submit.”

How to enroll

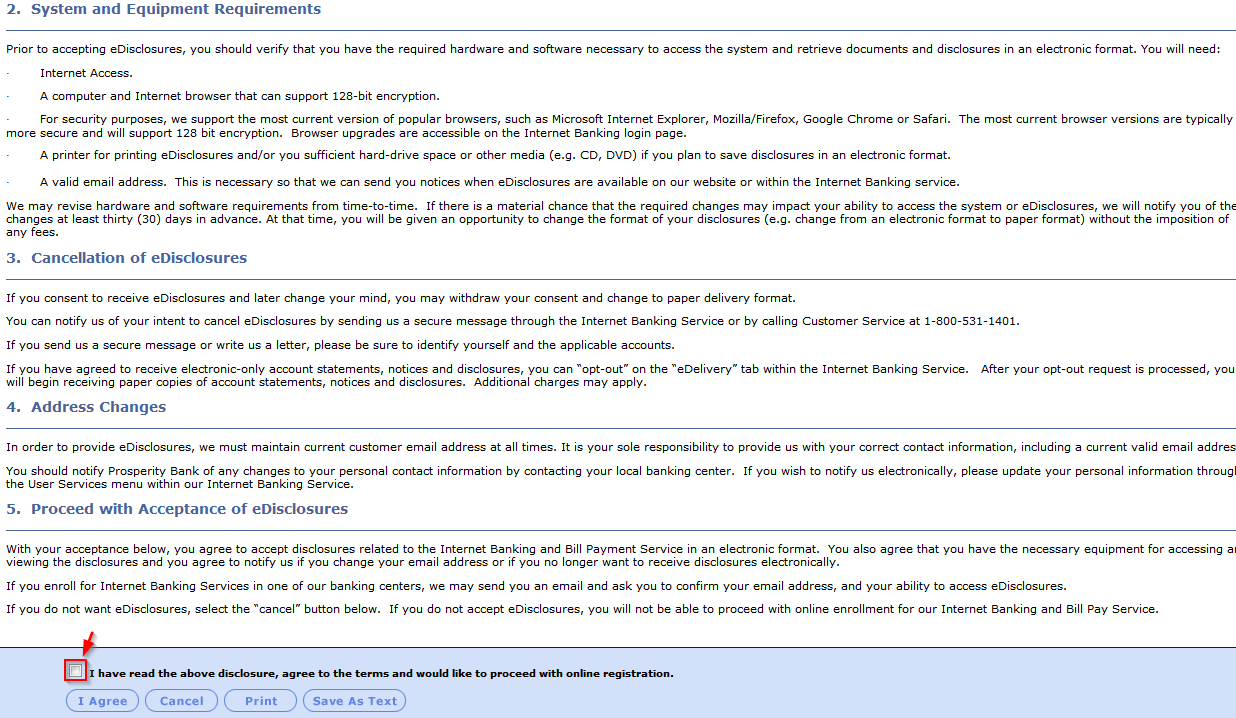

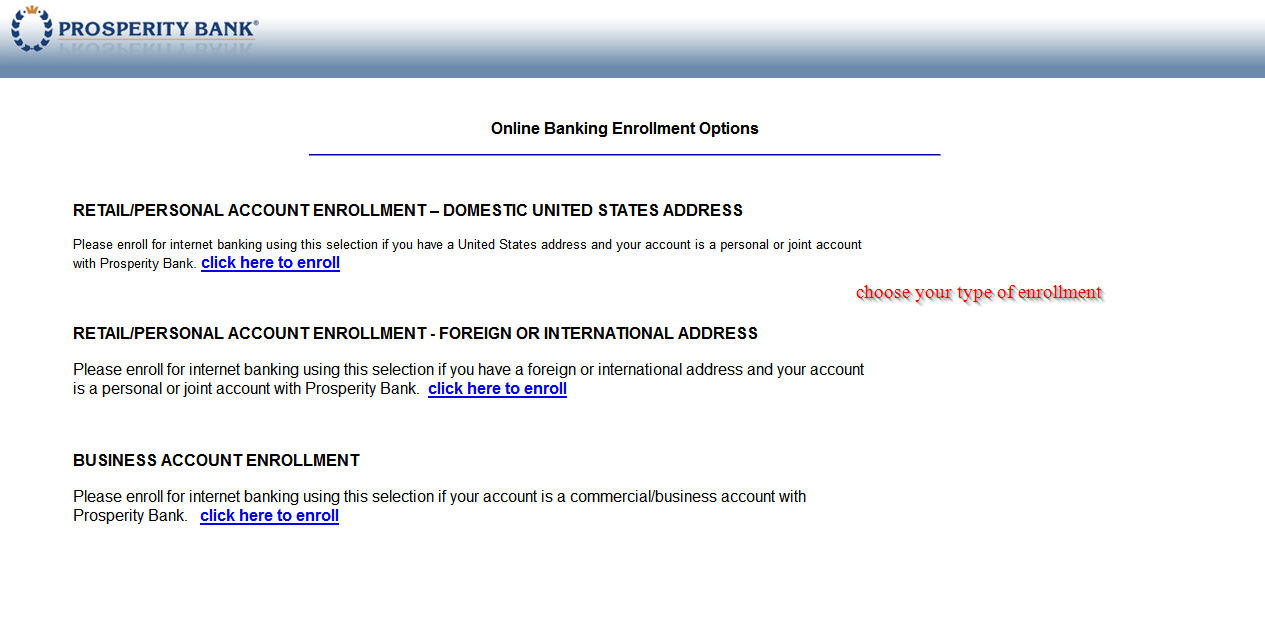

The bank has made it easy for their customers to enroll to the internet banking services offered. This service is only available to customers who have an account with the bank and once you are enrolled, you can login anytime and manage your bank account. Follow this guide enroll:

Step 1-Click “enroll”

Step 2– Read all the terms and conditions, check the small box to confirm that you have agreed to the terms and conditions and click “I agree”

Step 3-Fill in all the details in the page

Manage your Prosperity Bank online account

Manage your Prosperity Bank online account

Here are the benefits of having an online account with Prosperity Bank

- Makes it easy to pay your bills

- Online customer support

- Track your account balance

- Check your transaction history

Prosperity Bank Review

Prosperity Bank operates as a subsidiary of Prosperity Bancshares, Inc., a bank holding company operating in Texas and Oklahoma. The company is based in Houston, Texas.

Prosperity Bank is one of the most reliable and trusted banks in Texas. Banks are usually evaluated based with products, services and customer services and efficiency.

The multimillion dollar company has scored highly in all the three sectors. Customer reviews can attest to the fact as noted in this post.

Prosperity Bank services

Prosperity Bank offers a range of banking services for individual and commercial purposes. The customers they service consist of small to medium-sized consumers and businesses.

The bank’s services include individual and commercial banking services and products, online banking, debit cards, credit cards, mortgage service, mobile banking 24-hour voice response banking, trust and wealth management for consumers and commercial as well as retail brokerage services.

The bank’s IRA accounts provide clients with tax benefits on their retirement savings.

Personal banking products and services

Prosperity Bank offers a number of banking products and services for their customers. They include:

- Deposit products-Personal checking accounts, personal saving, money market and others

- Loan products-The bank offers car loans, home equity loans, home improvement loans and home loans among others

- Online services-Prosperity Bank customers have access to online banking services, internet banking enrollment, transaction alerts, eStatements, transfer of funds between accounts and others

- Other banking services that are offered to Individual customers include Trust services, customer debit and credit card, and investment services.

Business banking products and services

The bank’s services and products for business customers include:

- Deposit products-Business checking, certificate of deposit, business savings, money market and IRA’s

- Loan products-Commercial loans and SBA loans

- Online services-treasury management, internet banking, and internet banking enrollment

- Other banking services offered by the bank include Trust services, merchant services, corporate credit card, public funds services and investment services

Customer reviews

Prosperity Bank customers usually speak out to complain or recommend about the services provided by the bank.

The feedback from customers is what creates the reviews to which give you clarity as a potential customer in deciding whether or not to engage with the bank.

Benefits

Prosperity Bank is one of the best banks in the United States, providing reliable banking services and products. Here are the benefits of banking with the bank:

- Excellent customer service-Customer reviews have shown that a significant number of customers are happy and satisfied with the customer support services offered by the bank. They have termed the bank’s staff as helpful and friendly

- Loan approval-The importance of loans in this day and age cannot be underestimated and considering the fact that you are in business, you need a constant stream of cash to run your investment. A quick access to the bank will give the bank so much credit. A significant number of customers noted that the bank reviews and approves loan and mortgage quickly especially to individual and business customers. Loan offices are also helpful and they usually respond quickly to customers

Downsides

You will agree to the fact that a review wouldn’t be complete without talking about the downsides:

- Online services-Customers have complained of poor and slow online services. The bank’s 24-hour voice response is very poor with so many delays. Slow feedback when messages are sent. A few customers say that the automatic phone system has charged them a fee for transactions and check balances and their online banking is somehow complicated to log into for many customers.

- Parking-The bank has limited parking space for its customers

- Trust services-The Trust services have been an issue for some customers. Most customers say they don’t have confidence in the Trust services

- Debit cards-Customers have complained that they have to wait for a long time to receive their debit card and the bank does not offer temporary solution

- Savings account-Interest rates for Prosperity Bank savings accounts is poor when compared to other commercial banks

- Limited locations-Customers in certain areas have to travel for long distances to access the banking services offered.

Conclusion

Prosperity Bank is an average bank for customers who are looking for a bank that has excellent customer support and fast loan approval. However, their online banking services are poor and it takes longer to receive your credit or debit card