Webster Bank, N.A. provides financial services to families, businesses and individuals in Connecticut. The company operates as a subsidiary of Webster Financial Corp.

- Branch / ATM Locator

- Website: https://public.websteronline.com/

- Routing Number: 211170101

- Swift Code: See Details

- Telephone Number: +1 800-995-9995

- Mobile App: Android | iPhone

- Founded: 1935 (89 years ago)

- Bank's Rating:

Webster Bank has made it a lot easier for customers to get access to their bank accounts without necessarily going to the bank. With the internet banking services offered by the bank, it is easy for a customer to make payment, transfer money a friend account or even check their transaction history. If you have an account with Webster Bank and you are interested in the service, we guide you through the process of logging into your account, retrieving your password and registering for the internet banking services.

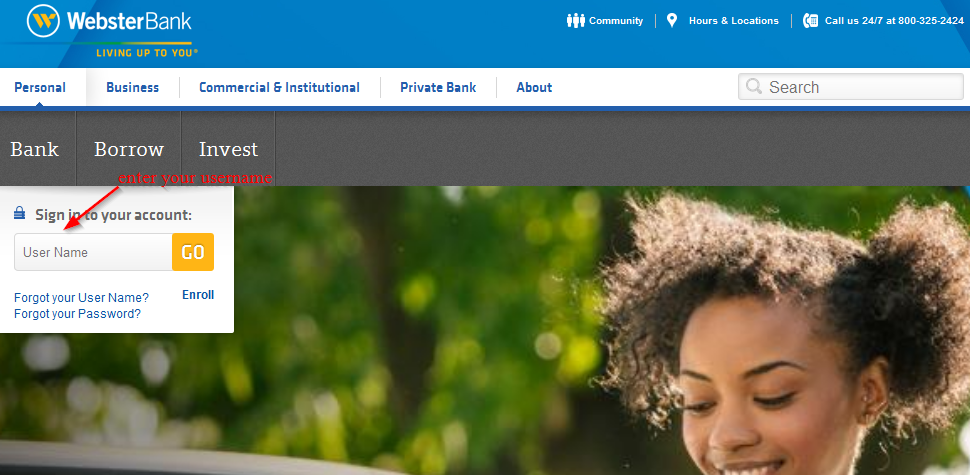

How to login

This is basically the simplest part of the internet banking services offered by Webster Bank since it only entails entering your login details to access your online account. Here are easy steps to follow in order to login:

Step 1-Open https://public.websteronline.com/ in your web browser

Step 2-Enter your username and click “go”

Step 3-Enter your password and click “continue”

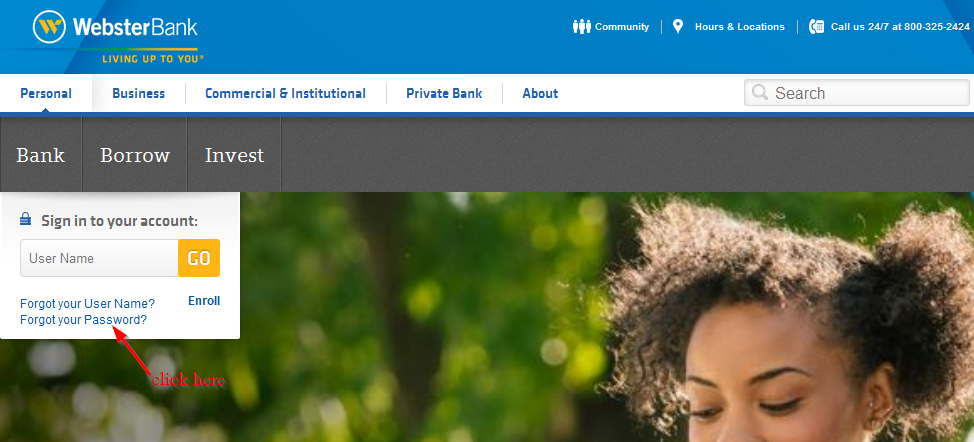

How to reset your password

Webster Bank has made it possible for customers who have an account with the bank to reset their passwords in case they forgot. In this case, you will only need your user ID to validate that you have an account with the bank. Here are the steps to follow in order to reset the password:

Step 1-On the website’s homepage, click “forgot your password?”

Step 2– Enter username and click “continue”

If you have forgotten your username, just click “forgot your username”

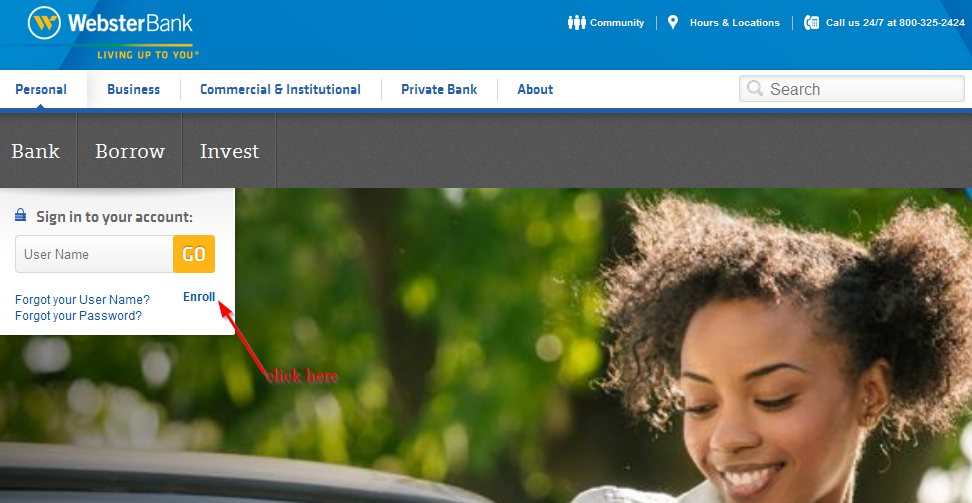

How to enroll

The process of creating an online account with Webster Bank is pretty straight forward. You will be required to provide certain details about your bank account. You will also need to provide certain details about your bank account, including bank account number SSN, etc:

Step 1-On the homepage, click “enroll”

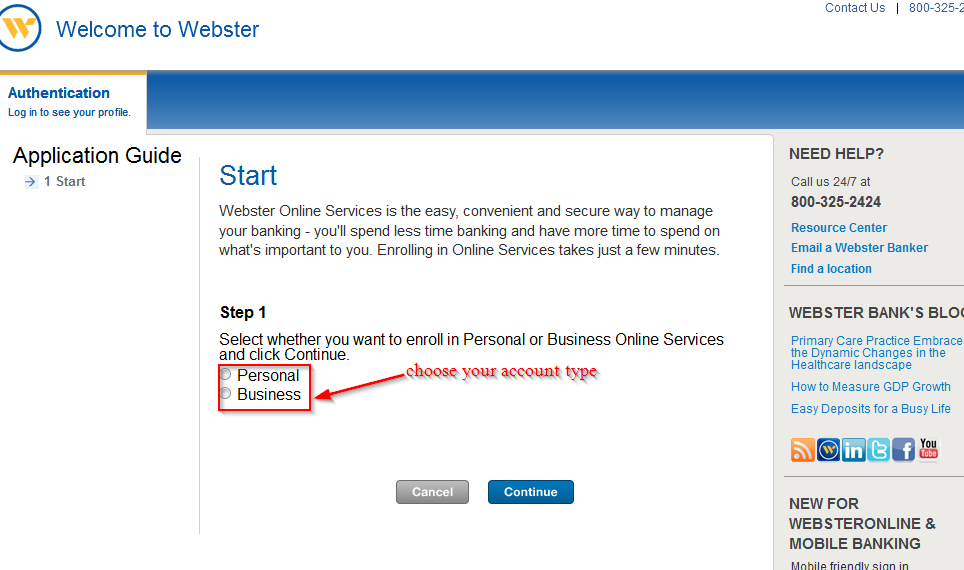

Step 2-Choose whether you want to open a personal or business account. In this case, we will choose “personal”

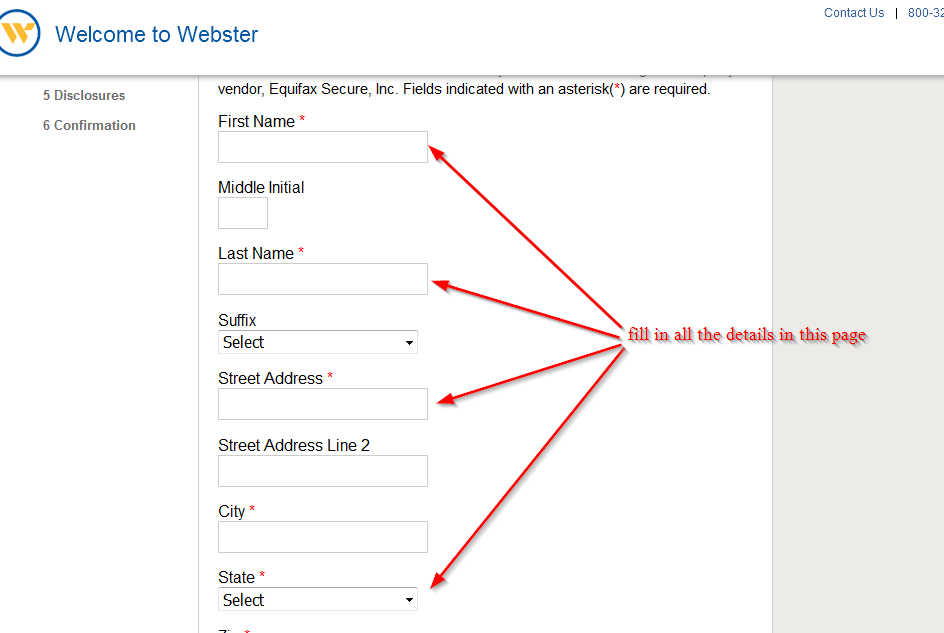

Step 3-Provide all the required details on the page and complete more steps

Manage your Webster Bank online account

The advantages of registering an online account with Webster Bank include:

- Full time access to your bank account

- You can easily locate an ATM or branch

- You can see your account balance

- Anywhere anytime

Webster Bank Review

Webster Bank has been providing financial services for more than 75 years and serves consumers and businesses. With more than 3,000 employees who are dedicated to helping their esteemed customers to reach their financial goals, the bank ranks No. 35 in the United States.

Webster Bank is based in Connecticut and operates in four states: New York, Massachusetts, CT and Rhode Island.

The bank was founded in 1935 during the Depression years when starting a bank was probably consider to be a ludicrous idea.

With USD 25,000 borrowed from private sources, which was anyway a big amount during those days, Harold Webster Smith founded First Federal Savings of Waterbury with the main goal of providing the community with home loans.

The same man who founded this institution lasted as the CEO of the bank until 1987 and as the chairman in 1995. During that time, the bank changed its name to Webster Bank and 7 years later, it was listed in the stock market as WBS.

That growth has lead to a financial institution that has a working basis of USD 20 billion in assets.

Webster Bank now provides banking services individuals, government agencies, companies and institutions. The bank also provides services to its tradition markets of home lending and expanded services in financial planning and advice, investing, planning and trust.

Webster Bank currently operates about 300 ATMs and 168 branches in four states. The bank also provides its online banking services, mobile banking as well as in-person office banking.

Through its subsidiaries, Webster Bank also provides agency customers wit capital asset financing and health savings administration for commercial customers.

As an institution, the bank is definitely in a position to grow further in the next decade and the bank is clearly moving into the acquisition mode that has been targeted to expand its market research to reach where possible.

As a result, customers are most probably going to see added services, especially business and commercial clients as the institution continues to growing and building its reach in technical services and other related markets.

The bank states that its objective is to be a leading financial institution in southern New England. If you are looking for a certificate of deposit, home mortgage or another financial product, the bank is the right place to begin your search.

Bank accounts offered by Webster Bank:

Checking accounts

Webster Bank has six different checking options that you need to know about. They include:

- Premier checking-Tiered interest rates and refunds for other bank’s ATM charges

- WebsterOne Relationship checking-Competitive interest rates and no fee for using other bank’s ATMs

- Webster value checking-Easy and affordable banking and special loan discounts

- Webster eChecking-No minimum balance and special loan discounts

- Webster student checking-low minimum opening deposit or $50 and no monthly fee

- Opportunity checking-Easy to qualify free visa debit card and low minimum opening deposit of $50

Saving accounts

You can choose a savings account from the options presented below:

- Premier savings extra-The rates for this account are as high as 0.35% APY

- Premier savings-Earn interest rates up to 0.3% APY on this account

- WebsterOne savings-Earn interest rates up to 0.20% APY on this account

- Premium money market savings- Earn interest rates up to 0.20% APY on this account

- Webster value savings- Earn interest rates up to 0.02% APY on this account

- Holiday club savings- Earn interest rates up to 0.03% APY on this account

Benefits

- Competitive interest rates

- Refunds for use other bank’s ATM

- Savings and discounts

- No minimum balance for some of its checking accounts

- No monthly fee for some of its accounts

- Better rates for larger balances

- Low minimum opening balance of $5 for saving accounts

- Monthly service charge can be waived

Downsides

- Customer have submitted complaints about the bank’s loan repayment, privacy, credit score reporting, account management and fees

Conclusion

Webster Bank is one of the best banks that you can bank with. It has better rates for larger balances, monthly fees can be waived if certain requirements are met, competitive interest rates and have a low minimum opening balance.

However, there have been a few complaints about the bank concerning account management, loan repayments and others.