Allied Bank offers personal and business banking products and services. Founded in 1942, the bank is headquartered in Lahore, Pakistan.

- Branch / ATM Locator

- Website: https://www.abl.com/

- Routing Number: 082902579

- Swift Code: See Details

- Telephone Number: 0800-22522

- Mobile App: See Details

- Founded: 1942 (82 years ago)

- Bank's Rating:

Allied Banki internet banking services are designed to help customers access their bank accounts from anywhere. Customers will access the bank’s website and login to access their bank accounts. In this guide, we will take you through steps on how to login into your online account, how to reset your password and how to enroll.

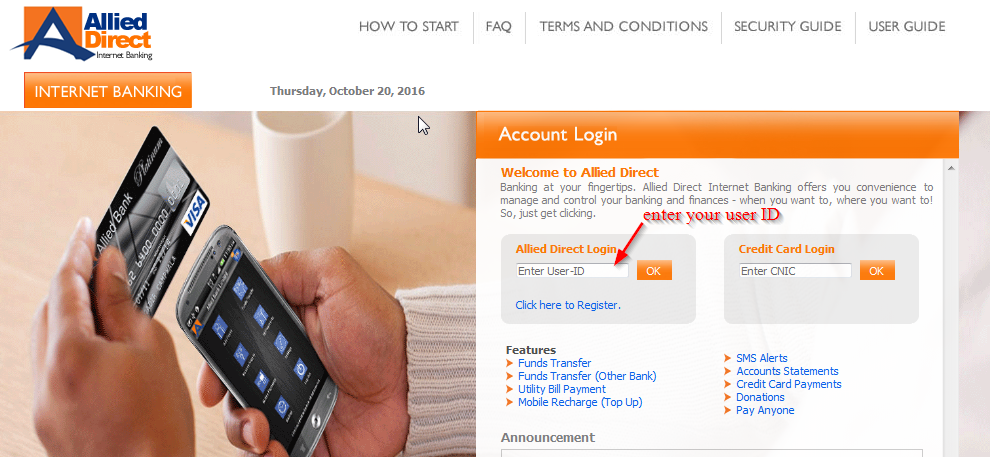

How to login

Logging into your online Allied Bank is easy provided you have valid login details. Customers can access their online accounts anytime anywhere so long as they have their login details. Follow these steps to access your online account:

Step 1-Open https://www.abl.com/ in your web browser

Step 2-Click login “login to Allied Direct”

Step 3-Enter your login ID and click “OK”

Step 4-Enter your password

Forgot your password?

If you have forgotten your password, you can reset it anytime to continue accessing your online account. However, to access the password page, you will need to use a valid user ID. This will help the bank to verify that you have an account with the bank.

Once you have used the correct password, you will be able to access the password page, click on the password reset link and provided the required details to reset your password. Unfortunately, we couldn’t get screenshots for this section.

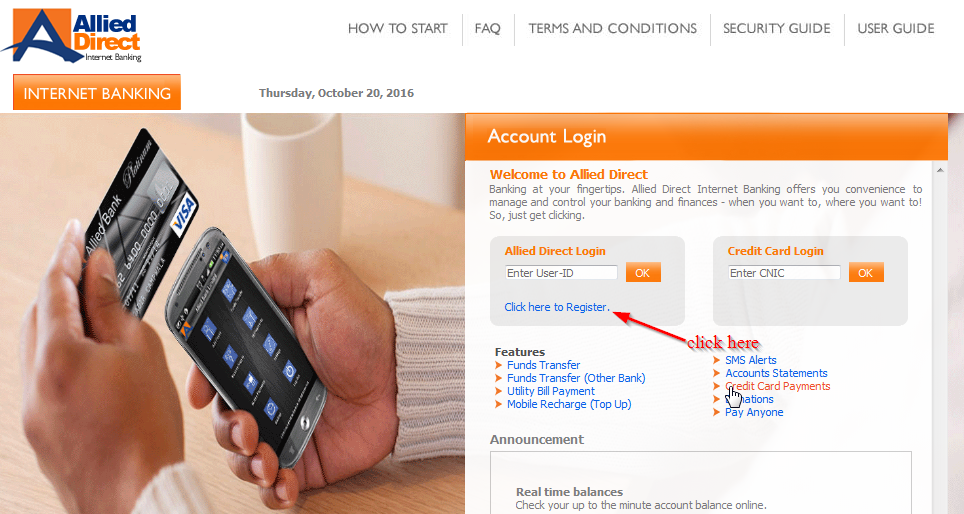

How to enroll

It’s free to register for the internet banking services offered Allied Bank. These services are only available to customers who have a bank account with the Bank. You will be required to provide details about your bank account. Follow these steps to enroll:

Step 1-Once again, start on the homepage and click “login to Allied Direct”

Step 2– Click “click here to Register”

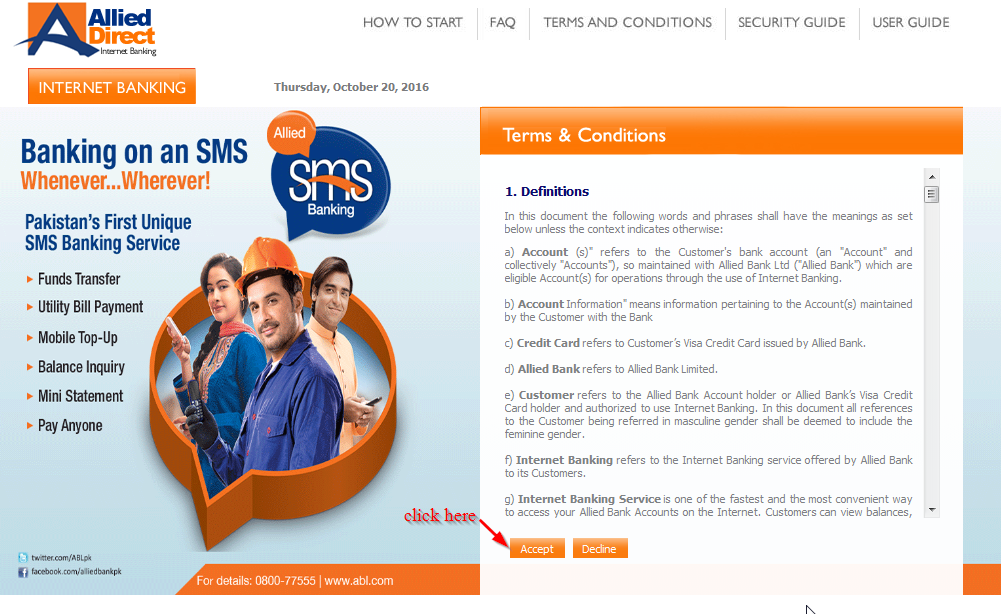

Step 3-Read the terms and conditions and click “accept”

Step 4-Fill in all the required details and click “submit”

Manage your Allied Bank online account

With an online account with the Allied Bank, you can do the following:

- Make payments anytime

- Transfer money between bank accounts

- Check transaction history

- View reports

- Access eStatements

- Report a stolen card

Allied Bank Review

Allied Bank is a financial institution bank in Pakistan. The bank has registered offices in Lahore and Karachi and is one of the largest banks with more than 1150 branches and ATMs. The bank was founded in 1942 under than name Australasia Bank.

The bank changed its named to Allied Bank in 1974 and merged with Pak Bank Limited, Lahore Commercial Bank and Sarhad Bank Limited.

Allied Bank provides its customers with a range of products and services to cater for their needs of investment as well as other business and social requirements. The bank maintains its status for innovation in education and embracing the latest technologies in the banking industry in Pakistan.

The bank’s current e-Banking services include Allied Direct-Internet banking, Allied SMS Banking, Automated Teller Machines and Transactions Alerts Facility.

Allied Bank offers a number of banking accounts that you should know.

Everyday accounts

Allied Bank has accounts for everyday banking and savings. The right bank account will help you to achieve your savings and transactional objectives. The account options that are available include:

- Khanum asaan account-This is an exclusively personalized bank account for women

- Allied asaan account-This account requires a minimum deposit of only Rs. 100/-

- Current account-The bank’s Rupee-based non-remunerative Current Account that suits your banking

- Allied Express account-This account does not require you to maintain a minimum balance or initial balance. It is also a hassle free and easy account for the Home Remittance Benefices.

- Allied Easy Current account-This account has no service charge on low balance

- Allied Basic checking account-This is the right account for those who want to avoid minimum balance requirement

- Allied rising star-This account has over 30,000 children

- PLS savings account-This account has over 1.5 million customers with their profit and loss savings account at the bank

Savings and term deposits

This is an interesting earning account. The longer the savings stay in your account, the more you will earn from it. Allied Bank savings accounts give customers the ability to earn some profit together with the flexibility of withdrawing funds whenever they want to. Profit on these accounts is earned based on the minimum deposit that is maintained in the account. Alternatively, you can invest in term deposit product to give you the safety of knowing that your profit shall not fluctuate

Term deposit mechanics

Term deposits are basically investment options that are offered by banks where customers deposit their savings for a certain period of time, upon which it would earn a certain percentage of profit. Let’s for example if you place a deposit for a period of one year at Allied Bank. The customer’s deposit will be kept safe till its maturity date. If you want to withdraw funds before its maturity date, pre-mature encashment charges will certainly apply.

Upon maturity date of term deposit, you can:

- Withdraw your principal deposit together with the profit that your savings have earned

- Or you simply roll over the money altogether or partially for another period to get more profit

Benefits

There are many benefits of banking with Allied Bank. As a matter of fact, the bank has received many good reviews from their customers. Here are more benefits:

- Free online banking

- Utility bills payment

- SMS banking on smartphones

- More than 50,000 outlets in Pakistan

- Download account opening form on the bank’s website

- Savings account is an interest-earning account

- No or minimum balance requirement for its accounts ‘

- Around the clock customer support

- Access to a wide network of ATMs

- Safe and secure platform for customers to bank

- Unlimited access to the bank’s accounts

Downsides

Allied Bank is one of the best banks in Pakistan, but you will agree to the fact that a review is not complete without talking about the downsides of the bank. They include:

- Must visit the nearest branch to open an account

- No live chat support

Conclusion

Allied Bank is one of the top rated banks in Pakistan with a range of banking accounts. The bank also has accounts that are exclusively for women and children. There is also profit and loss sharing account, which is just great for anyone who wants to bank. However, the bank does not have live chat support and you must visit the nearest branch to open an account