Great Western bank provides business and agribusiness, retail banking, and wealth management services. The bank is a subsidiary of National Americas Holdings LLC.

- Branch / ATM Locator

- Website: https://www.greatwesternbank.com/

- Routing Number: 091408734

- Swift Code: See Details

- Telephone Number: +1 712-323-7125

- Mobile App: Android | iPhone

- Founded: 1935 (90 years ago)

- Bank's Rating:

Great Western Bank online banking is a resourceful platform for your business and personal transactions. It gives you full time access to your bank account, and it’s also free and convenient. Here is a guide on how to login, retrieve your forgotten password and registering for the free internet banking services.

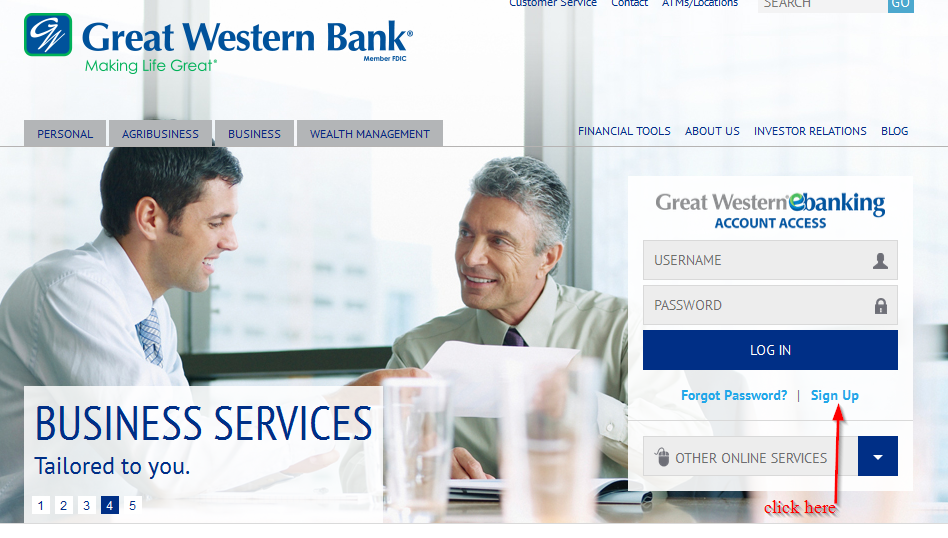

How to login

Great Western Bank has made it easy for customers to conveniently login into their online platform and manage their bank accounts. With its easy to user friendly interface, it’s easy to login into your online account. Follow these simple steps to login:

Step 1-Open https://www.greatwesternbank.com/ in your web browser

Step 2-Enter your username and password and click “log in”

You will be able to navigate to your dashboard as long as you have used the correct logins

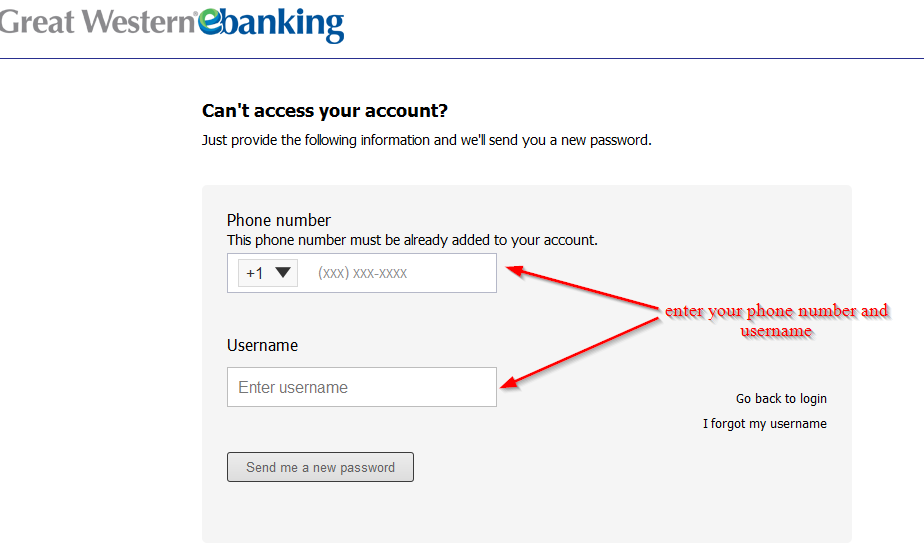

How to change your password

You can only login into your online account if you use a valid password. The process of changing your password is pretty straight forward as it only takes a few minutes. To regain access to your online account, you will need to provide your password:

Step 1-Click “forgot password” on the bank’s homepage

Step 2-Enter your phone number and username and “submit”

You will receive a new password in your email address

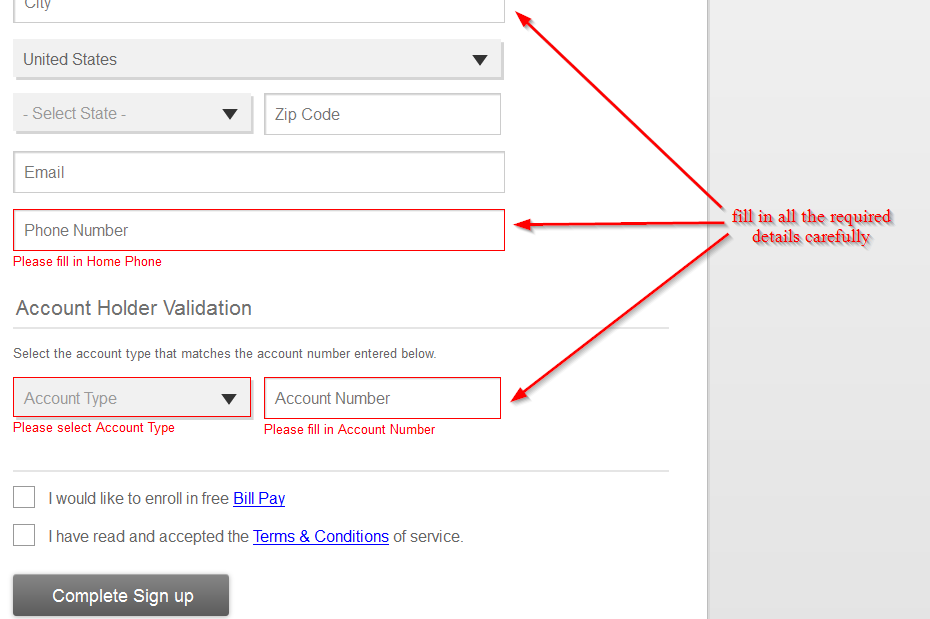

How to enroll

It’s easy to enroll for the online banking services. Just like setting up your Facebook and Twitter account, you will need to provide certain details. Follow these steps to enroll:

Step 1-Go to the Homepage and click “sign up”

Step 2– Fill in all the required details including username, password, names, company, date or birth, mother’s maiden name, social security number, street address, city, United States, email address, phone number and check the small box to confirm your have agreed to the terms and conditions and click “complete sign up”

Manage your Great Western Bank online account

Manage your Great Western Bank online account

Here are some of the advantages of having an online account with Great Western Bank:

- Check your account balance

- Pay bills

- Transfer funds to other bank accounts

- Apply for mortgage

- Find the nearest ATM location

Great Western Bank Review

Great Western Bank is a regional bank and subsidiary of Great Western Bancorp, Inc. The bank is a headquartered in Sioux Falls, South Dakota. Great Western Bank has more than 170 locations in South Dakota, Arizona, North Dakota, Colorado, Nebraska, Iowa, Missouri, Kansas, Missouri and Minnesota. The bank has assets worth $11.45 billion.

The bank has been committed to their mission, which is to make life better for more than 80 years. The bank is committed to doing everything possible to make sure that their customers have an easier financial live and are more secure, something that is seen in their personable and friendly service.

Agribusiness lending

Great Western Bank supports farmers and other people who have ventured in the business of agriculture. They form part of most recognized farm lenders in Colorado and it is the 7th largest farm lender in the country.

The bank has been helping farmers to finance their dream for more than 80 years. They have a team of experienced professionals who understand the business and can advise farmers on the best financing solutions.

In addition, the bank understands that farmers are busy during the day, so if they don’t make it to the nearest branch, an agricultural specialist at the bank will go to them. All agribusiness customers are assigned a personal banker who will remain in contact with them year after year, thus giving them a personalized experience.

VIP free interest checking

This account gives customers a VIP experience when it comes to a free checking account. The interest-earning checking account is 100% free and only requires that only an automatic loan payment or direct deposit be set up.

The features of this account include: free paper statements, $50 minimum deposit needed to open an account, no monthly service fee, and simple monthly interest compounded, free online banking and Bill Pay, free access to Visa checkout and free mobile banking.

Debt consolidation

Great Western Bank is one of the leading banks in Colorado that believes in making loan decisions locally as well as approving loans quickly. The bank realizes that sometimes people find themselves in financial difficulties and need help finding a way out.

The bank offers solutions to customer who need help with getting their finances back to track. With the back debt consolidation loan, the bank can help customers to streamline debt with a very much affordable monthly payment.

This program helps customers to concentrate on saving and improve their financial status.

Certificate of deposits

Great West Bank Certificate of Deposits offers a solid investment that can earn more than a savings account. Returns on a Certificate of Deposit account at the bank are guaranteed, and they also come with various short-term and long-term options to choose from.

Certificate of Deposit can be reviewed automatically and they offer these features: tiered rates, $500 opening deposit, terms available for 7 days to 5 years, highly competitive rates and rate option on CDs can be raised with terms of 2 to 5 years.

Benefits

Great Western Bank is one of the most trusted banks in the United States. With more than 1,500 employees, the bank works hard to make sure that it takes care of its customer’s financial needs, including providing farmers with loans. Here are more benefits of choosing Great Western Bank:

- Requires an average initial deposit of $50

- The $6 account fee is relatively low

- Online banking and Bill Pay available

Downsides

Great Western Bank is a good bank as you can see on the benefits, some of which we have not listed here. But a review wouldn’t be complete without talking about the downsides of the bank:

- The bank does not offer interest rate

- The bank overdraft fee is generally higher than average

- Limited number of locations

Conclusion

As you can see, Great Western Bank has its own benefits and downsides, which you must know before deciding whether to open an account with the bank or not. The information we have provided above should help you to make an informed decision. Great Western Bank is indeed a great bank, but you must know that they have limited number of branches. They also don’t offer interest rate.