Sovereign Bank was founded in 2004 to offer a myriad of banking services such as deposits, commercial and industrial lending, SBA loans, private banking, and real estate lending among others. The bank has more than $1.5 billion of assets and about 10 branches.

- Branch / ATM Locator

- Website: https://banksov.com

- Routing Number:

- Swift Code: See Details

- Telephone Number: 1-800-949-0214

- Mobile App: See Details

- Founded: 2004 (20 years ago)

- Bank's Rating:

Sovereign Bank is a regional bank offering a myriad of services to various clients who include private citizens, government, commercial, industrial and small businesses. In 2014, the bank reported total assets of $1.4 billion. The bank has about 10 branches and a number of digital platforms such as a website that you can access from your computer or mobile devices, and mobile applications.

HOW TO LOGIN

Step 1. The first thing to do to login to your online account is to visit the website at https://banksov.com/

Step 2. In the next step, on the homepage, under the Online Access, go to Personal Banking as shown below.

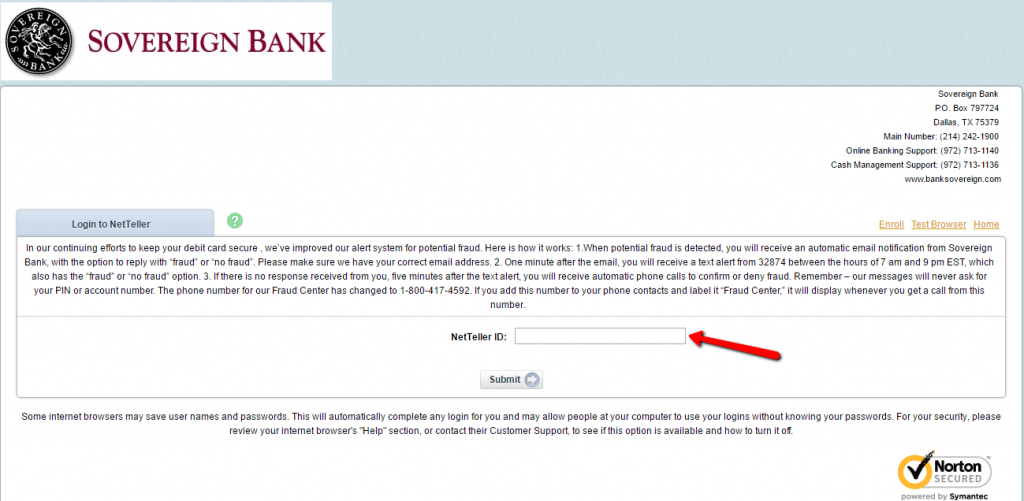

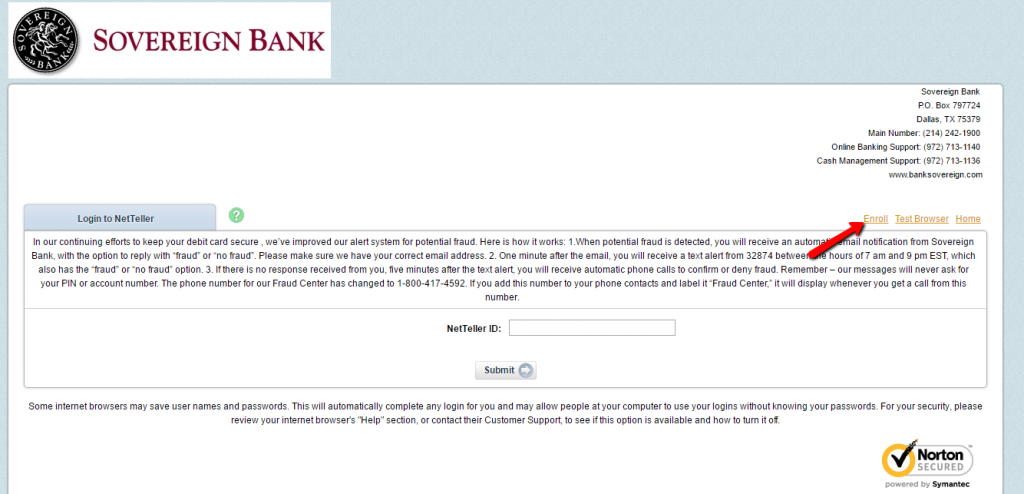

Step 3. In the next page, you should enter your user ID. Before you do this, you should carefully read the information in the page.

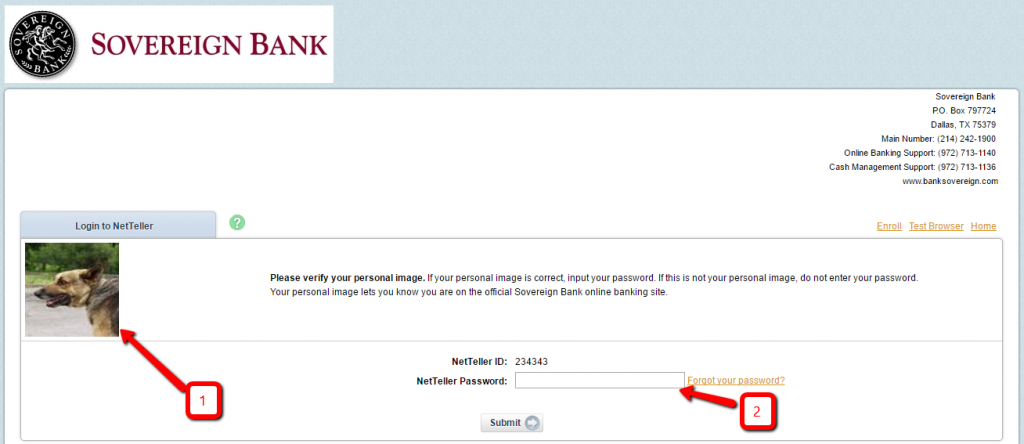

Step 3. On the next page, confirm that the image shown (1) is what you have preset for your account. If it is, you should enter your password (2) and then submit.

If you have entered the correct information, you should then be taken to your account.

HOW TO RECOVER YOUR PASSWORD

To recover your password, you should follow the steps below.

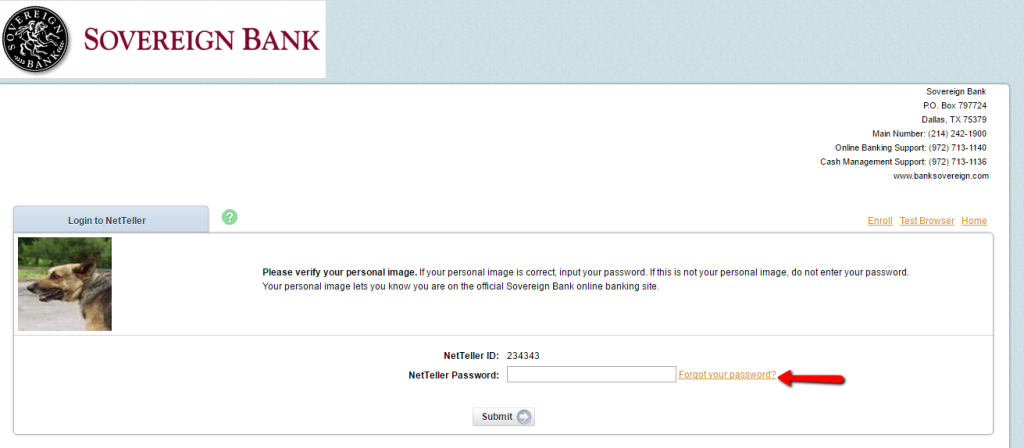

Step 1. To recover the password, you should follow the steps shown above.

Step 2. In the image shown below, you should follow the Forgot Your Password link.

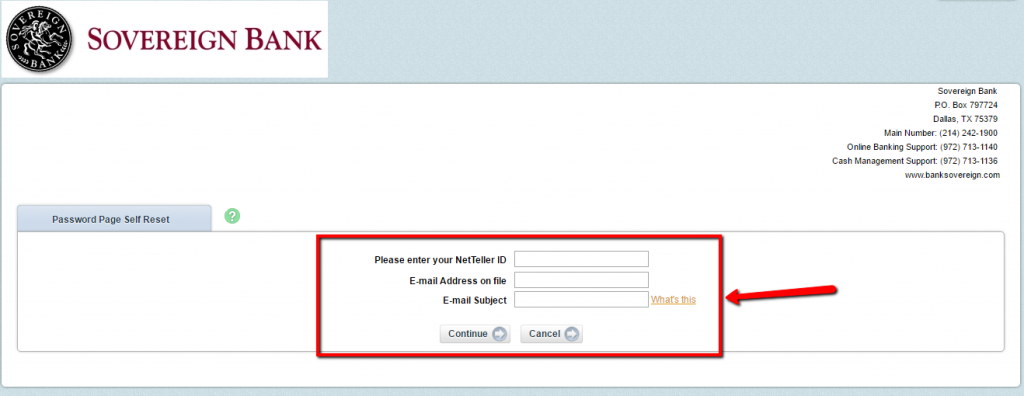

Step 3. On the next page, enter your Neteller ID, your email, and your email subject.

If you don’t understand what the e-mail subject is, you should click What’s this. This will take you to a new pop up explaining what the subject is.

HOW TO ENROLL

To enroll for online banking, you should follow the steps below.

Step 1. In the homepage, click to Personal Banking as explained in the first step.

Step 2. In the new page, click Enroll as shown below.

Step 3. On the next page, read the disclosure carefully and if you accept it, click I agree.

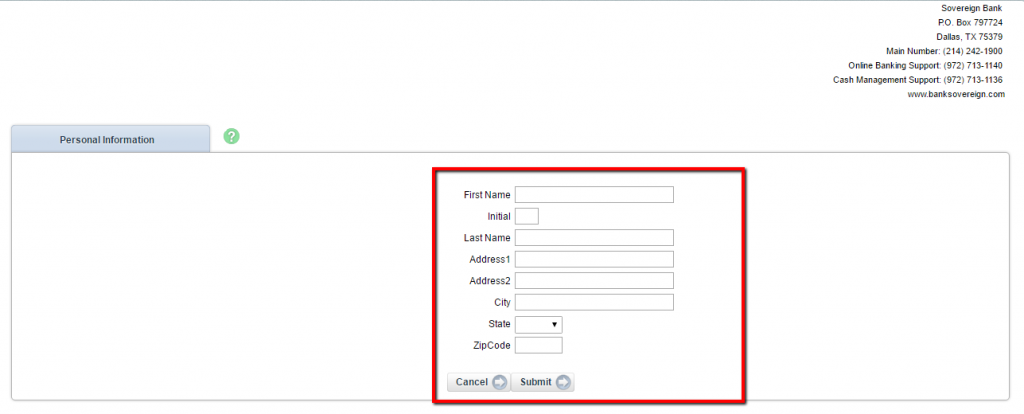

Step 4. On the next page, enter your information as requested.

Step 5. After this, you will be taken to another page to complete your registration.

WHAT YOU WILL FIND IN THE ONLINE ACCOUNT

In this account, you will be able to perform a number of transactions such as viewing your history, checking your balance, taking a loan, and monitoring your account.

Sovereign Bank Review

Many people choose a bank because of its products and financial health; however, these are not the only factors that you should take into consideration when choosing a bank.

A financial institution that offers excellent customer support and has a good reputation in the community can improve satisfaction and build confidence.

Credit Unions and banks are key landmarks in many communities today and have because of the many options, you may wonder where the right place to save your money is. If you are looking for a bank that has a long history, then you should consider banking with Sovereign Bank.

The bank was founded in 1902 and is one of the largest banks in North-eastern United States, and over the years, the bank has gone to a greater length to provide its customers with innovative products and excellent service.

Products and services

Sovereign Bank is more than a savings bank as it offers a number of products and there is always something for everyone who wants to bank. Get to know the bank and choose an account that will best suit your financial needs.

Checking account

The bank offers 5 different types of checking accounts that you should know: The basic checking account is perfect for people who are looking for a low-cost way of managing their bills. There is also the Premier checking account with earns interest on balances.

A student checking account is also available to students who are between the ages of 16 and 22 and has no minimum balance requirements and no monthly fees. Other checking account options include Preferred Plus Checking and Classic Checking

Savings accounts

With a savings account, you will be able to reach your savings goals and there are four different types of Sovereign Bank savings accounts: Triple Your Interest Savings, A Money Market Savings, a Sovereign Goal Savings and a Statement Savings.

These accounts include competitive interest rates. In addition, your monthly maintenance fee can be waived if you meet certain requirements.

Regardless of your savings goal, whether it is planning for retirement, buying a house, saving for vacation or anything else, you will find an account that is right for you.

CD Rates

A regular money market or savings account can help you to jump-start your savings. But you don’t need to stop there.

There is Sovereign Bank CD rates, which are competitive and if you open a short-term or long-term CD, you will be able to grow your money very fast. You can choose a term of between thirty days and ten years and you can automatically renew your CD when it matures.

Mortgage rates and loans

It goes without saying that buying is one of your main purchases and you want to get the best interest rate.

Whether you are looking for a fifteen year, thirty-year or mortgage refinance, the bank’s mortgage rates are very competitive and you can be sure that you will find updated rate details on the bank’s website.

Customers can also get pre-approved for home loan via the internet. The bank’s mortgage representative will help you with finding the right home loan term and mortgage program.

Credit cards

Are you looking for a bank that offers credit cards with rewards program? Sovereign Bank credit cards may end your search.

When you apply for this credit card, you will earn two reward points for every one dollar. You will also enjoy zero percent interest on balance transfer for the first eighteen months.

Benefits

- Free online banking

- Free mobile banking

- Free access to bank account online. Customers can pay bills, locate ATMS, and transfer funds

- Many locations throughout the North-eastern region

- Excellent customer service

- Maintenance fee can be waived if certain requirements are met

Downsides

- Limited locations

- Limited number of ATMs

Conclusion

Sovereign Bank is one of the best banks in North-eastern U.S. It has many years in the banking industry and that’s what gives the bank an edge over other banks in the industry. Their mortgage rates are very competitive and savings account are very lucrative.

There is also CDs which will help you earn interest. You can also avoid the maintenance fee on accounts when you meet certain requirements. In addition, you can bank online.