BB&T is one of the largest banks in the United States with more than $200 billion in assets and more than 13,000 employees. The bank offers a number of services such as savings, lending, and commercial and government banking.

- Branch / ATM Locator

- Website: https://www.bbt.com

- Routing Number: 0622-0398-4

- Swift Code: BRBTUS33

- Telephone Number: +1 800-226-5228

- Mobile App: Android | iPhone

- Founded: 1872 (152 years ago)

- Bank's Rating:

BB&T is one of the largest financial services company in the United States. The bank provides multiple banking services to millions of clients through its hundreds of branches and digital platforms. It has grown for over hundreds of years organically and through acquisitions. It has more than 33,000 employees.

HOW TO LOGIN

To login to your BB&T online bank account, you should follow the following steps.

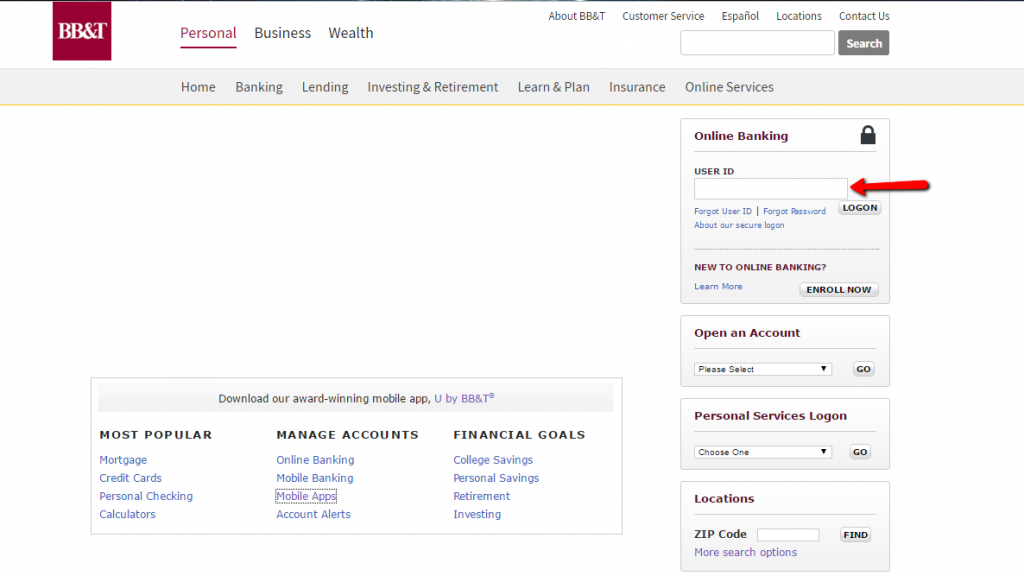

Step 1. Go to the bank’s website at www.bbt.com

Step 2. In the homepage, enter your user ID in the slot shown below.

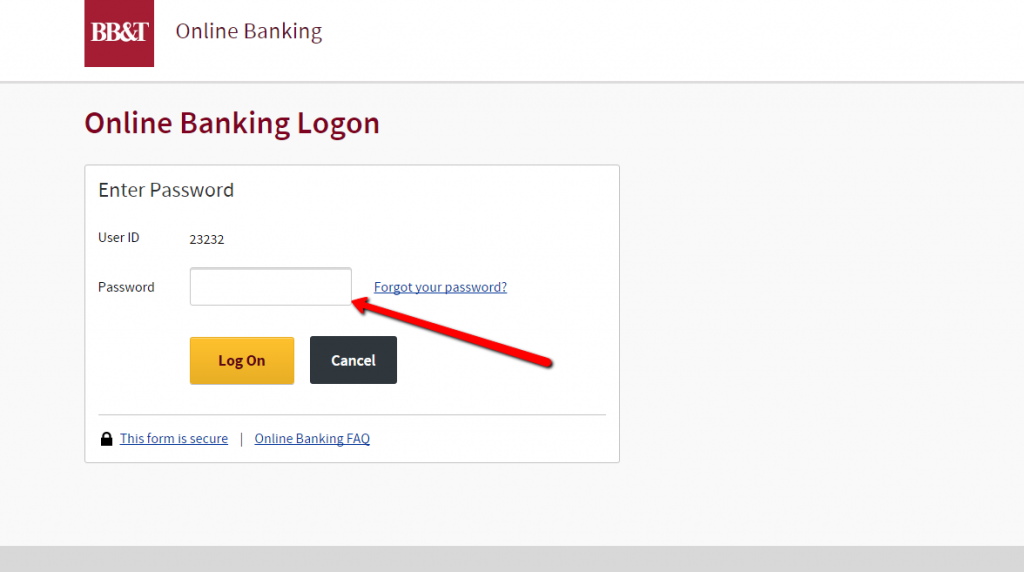

Step 3. In the next page, enter your password and click logon.

If you enter the correct password, you will be taken to your online account where you can transact.

HOW TO RESET YOUR PASSWORD.

If you have forgotten your account password, you should follow the steps below.

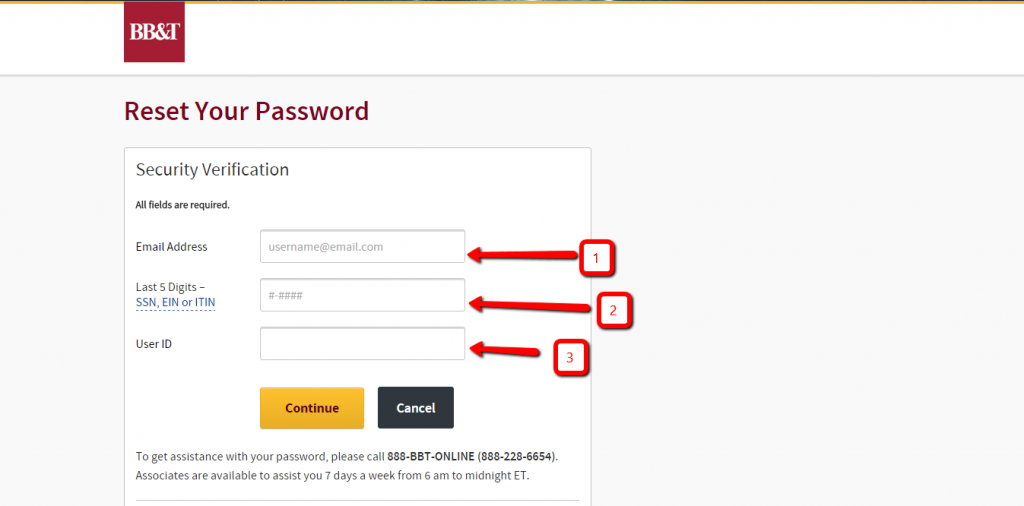

Step 1. The first step is to go to the homepage and enter your account number as shown above.

Step 2. In the next page, you should click Forgot Password which will take you to the next page.

Step 4. In this page, you should enter your email address (1), your User ID (3), and the last 5 digits of your SSI (social security number, or employer identification number, or tax identification number).

After doing this, you will receive an email message with your password reset link which you should follow to reset your password.

HOW TO CREATE AN ONLINE ACCOUNT

To enroll for online banking, you should follow the steps below.

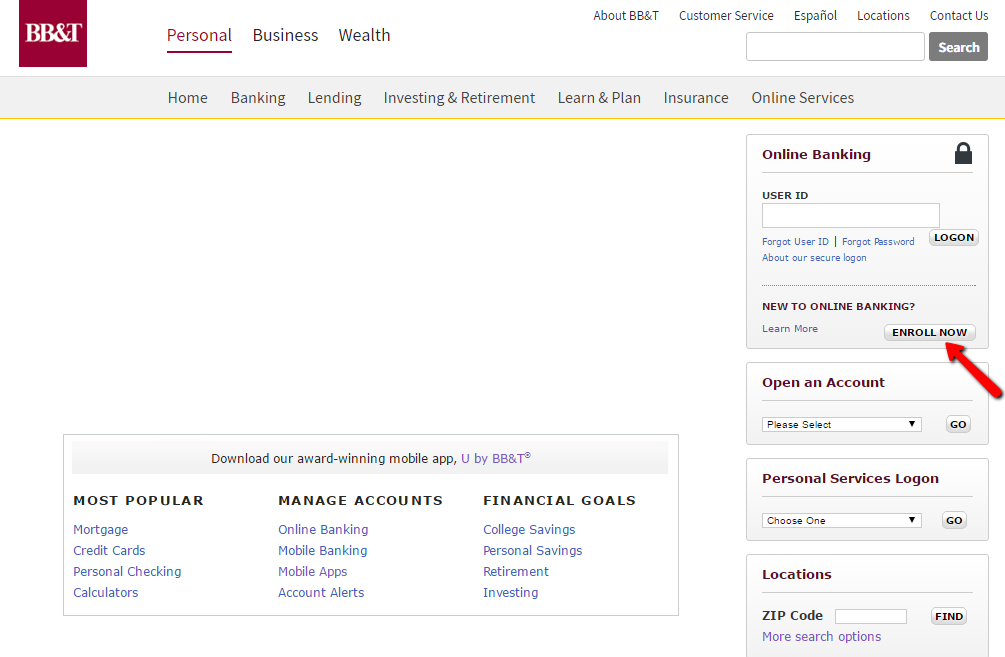

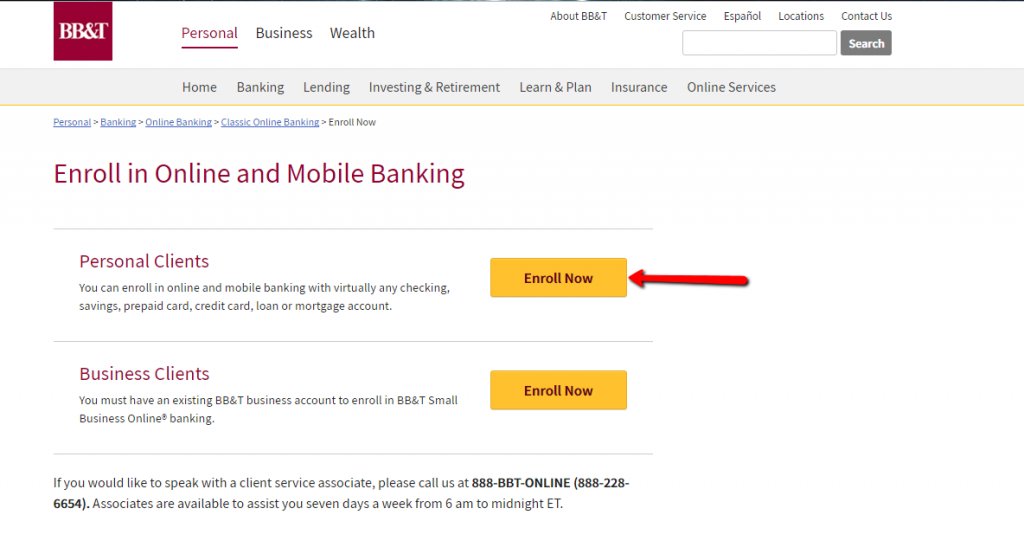

Step 1. The first step is to go to the website and then click the enroll now button as shown below.

Step 2. In the next page, select your preferred account type. If you are a personal account holder, select the first option and then enroll now.

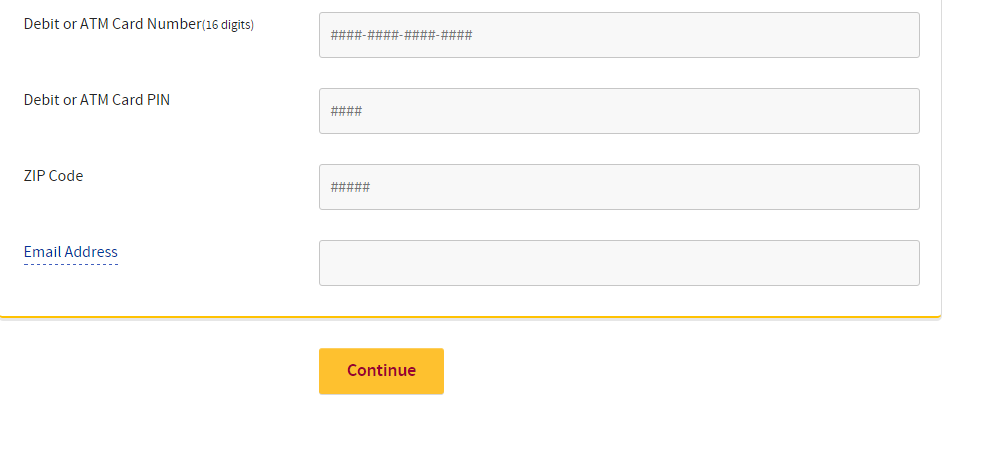

Step 3. In the next page, select one of the options shown below.

Step 4. Depending on the option you select, enter the information that follows.

After doing this, you will receive an email confirmation with your online banking information.

WHAT YOU WILL FIND IN THE ONLINE ACCOUNT

Your online account will give you the capability to transact remotely.

Some of the features you will find include the ability to: send money, make payments, check your account balance, and request a checkbook remotely among others.

BB&T Bank Review

BB&T Bank was founded in 1872 and has continued to build on their reputation and striving for excellence in the community till today.

The bank offers its customers a wide range of financial services. The services and features include: banking, insurance, lending, trust, and wealth management.

Benefits

There are many benefits of banking with BB&T Bank, and in this post, we will be looking at some of the reasons why you should open an account with the bank.

- Great services

BB&T Bank offers numerous banking, investing, and lending solutions to customers in a number of states in the U.S. The bank’s operation is insured and backed by the FDIC and all transactions and payments are secure.

In addition, they meet all the requirements that allow them to be considered to be an equal housing lender. The bank also offers insurance options for people who want to receive loans.

- Checking account options

There are five different checking account options offered BB&T Bank. All the options offer a number of useful features, which include a number of restrictions.

Individuals who bank with BB&T Bank can open a new account online or upgrade their checking account without necessarily visiting a physical branch. Each BB&T Bank checking account includes paper statement capabilities.

In addition, the bank’s checking account offer mobile and online banking with personal financial management tools through BB&T ATM withdrawals, phone24 automated inquiries and U by BB&T. The checking account options include:

BB&T Fundamental Checking-This is a basic account that comes with a monthly fixed fee that is easy on almost any budget. This account includes a monthly maintenance fee of $5

BB&T Bright Checking-For people who plan set up a direct deposit for paycheck or a regular deposit. This account includes a maintenance fee of $12 a month, but you can always avoid it.

Elite Gold-This account is designed people who have a high-balance account or mortgage with the bank. The bank requires a monthly fee of $30 but the fee can be waived if you don’t meet the restrictions

Student checking-This is the perfect account for students who are looking for a stress-free checking with zero balance requirement. This account does not have a monthly maintenance fee

Senior checking-This account is for those people who are at least 55 years old, easily-waived maintenance fees and want free checks. The account has a monthly maintenance fee of $10, but you can avoid it.

- Savings account options

BB&T Bank offers two different types of savings accounts for people who bank with the bank. Just like the varying checking account, all the savings accounts are designed to benefit certain consumers and with its own restrictions and benefits.

Both the savings accounts include online banking, mobile banking, account alerts and combined statements. The savings accounts can be broken down into:

BB&T eSavings-This account is meant for customers who are looking for competitive interest rates. This account has not interest compounded daily and there is no minimum deposit.

Investor’s Deposit Account-If you are an investor looking for premium interest rates, then this account will meet your needs. The minimum deposit requirement is $10,000 and the interest is usually compounded in a tiered system

Downsides

BB&T Bank has a number of downsides that you should know:

- Limited insurance

BB&T Bank also offers insurance services. But the insurance services are not insured by FDIC and are not guaranteed by the bank. In addition, the insurance is not backed by any federal government agency or state. The value of the insurance may also go down.

- Limited availability

BB&T Bank is only found in 16 states in the United States. This means a large part of a large portion is eliminated and may therefore not be an option for certain prospective customers.

- Monthly maintenance fee

A majority of BB&T Bank accounts require monthly fee. Although some accounts have requirements that if met can help you avoid the charges, that option has not been provided for all accounts.

Conclusion

BB&T Bank offers a number of banking and lending services that are common in the industry. But they offer a number of options designed to help consumers get the best banking experience.

If you choose to bank with BB&T Bank, you should expect a number of savings and checking accounts to choose from, options for different consumer situations and, individualized attention on investing endeavors.