South State Bank provides personal and business banking services. The bank was founded in 1934 and is based Orangeburg, South Carolina and operates a subsidiary of South State Corporation.

- Branch / ATM Locator

- Website: https://www.southstatebank.com/

- Routing Number: 053200983

- Swift Code: See Details

- Telephone Number: (800) 277-2175

- Mobile App: Android | iPhone

- Founded: 1934 (90 years ago)

- Bank's Rating:

If you have a South State Bank online account, you can register for internet banking services offered by the bank. With an online account, you can check your account balance, send money to a friend or family member, pay your bills, and so much more. These are among the many advantages of enrolling for internet banking services offered by the bank. If you are interested or unsure, follow this short guide to learn more on how you can login, reset your password and enroll for the internet banking services.

How to login

Provide you have created an online account with the bank; you can login anytime and make payments or simply access the internet banking services offered. However, to login, you will need to use valid logins; otherwise, you will be blocked. Here are the steps to follow to successfully access your online account:

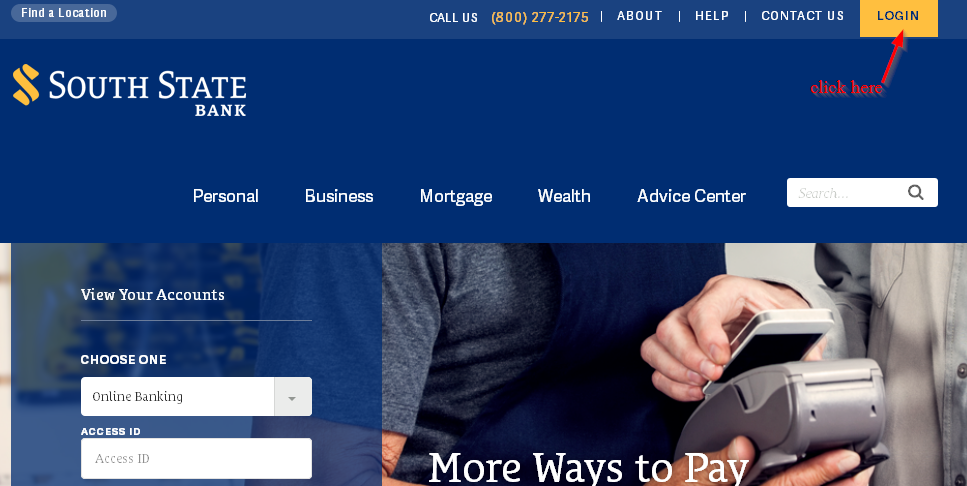

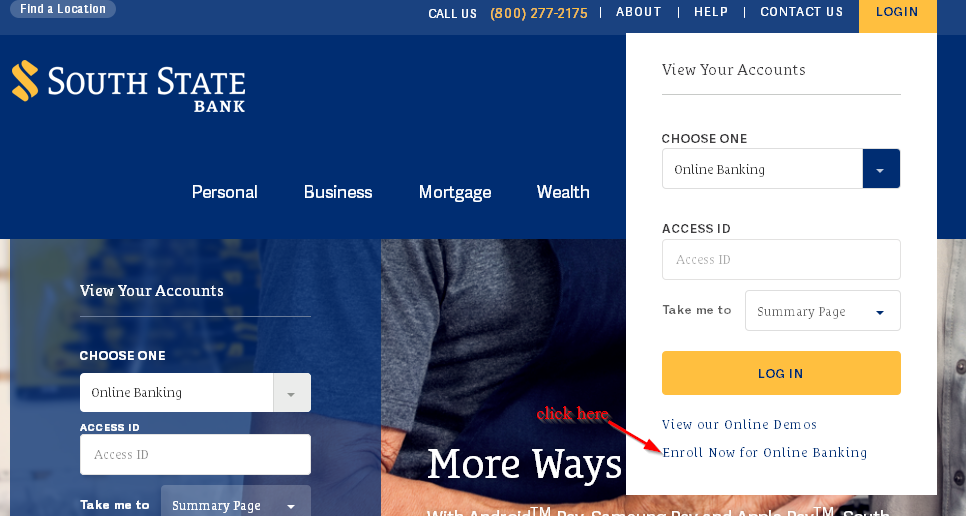

Step 1-Open https://www.southstatebank.com/ in your web browser

Step 2-Click “login”

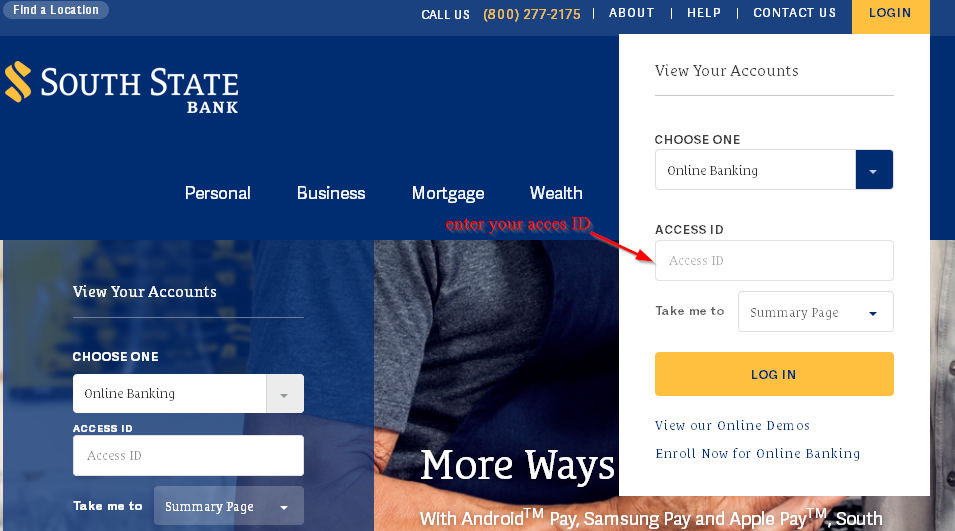

Step 3-Enter your access ID and click “login”

You can access your online account from anywhere provided you are using valid logins

Forgot your password?

South State Bank has made it possible for customers to reset their password anytime. This is very important because you may want to reset your password for security purposes or because you can’t remember the password. Follow this step by step guide to reset your password:

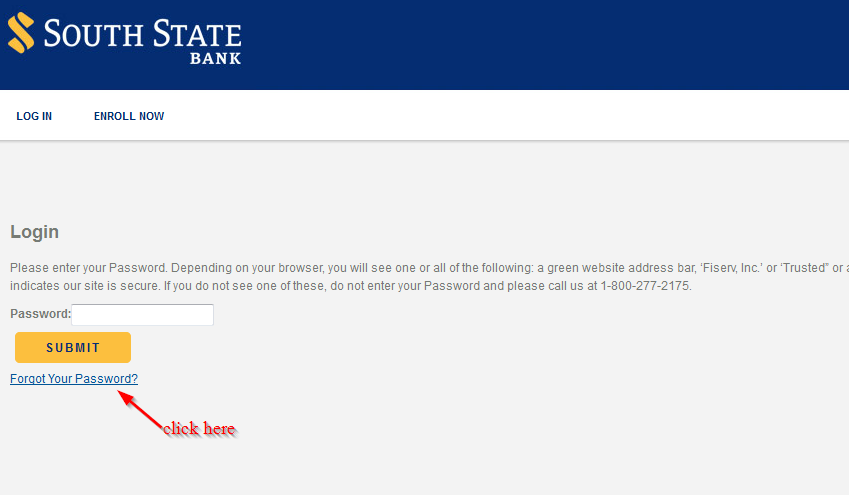

Step 1-Go to the homepage and enter your access ID and click “login”

Step 2-Click “forgot your password?”

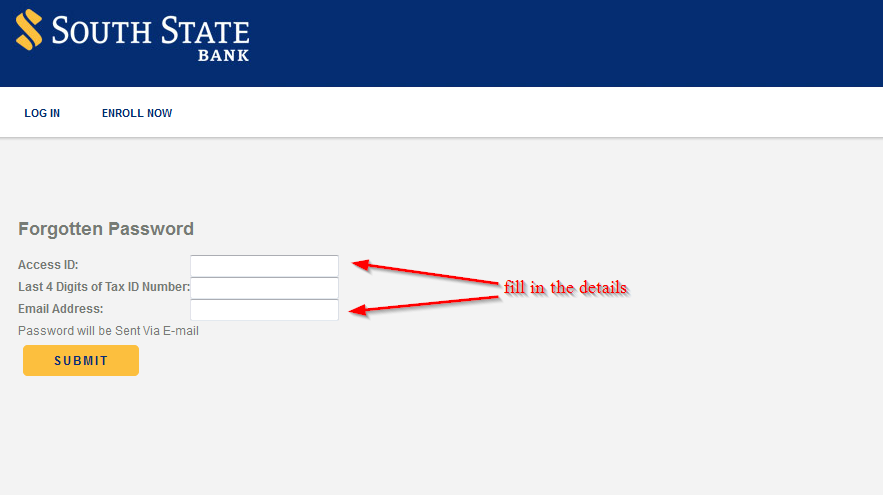

Step 3-Enter your access ID, last 4 digits of your Tax ID number and email address and click “submit”

The bank will send you a new password via email

How to enroll

If you have a bank account with South State Bank is easy as long as you have an account with the bank. It’s a simple step by step process that only takes a few minutes. Here are the steps to follow:

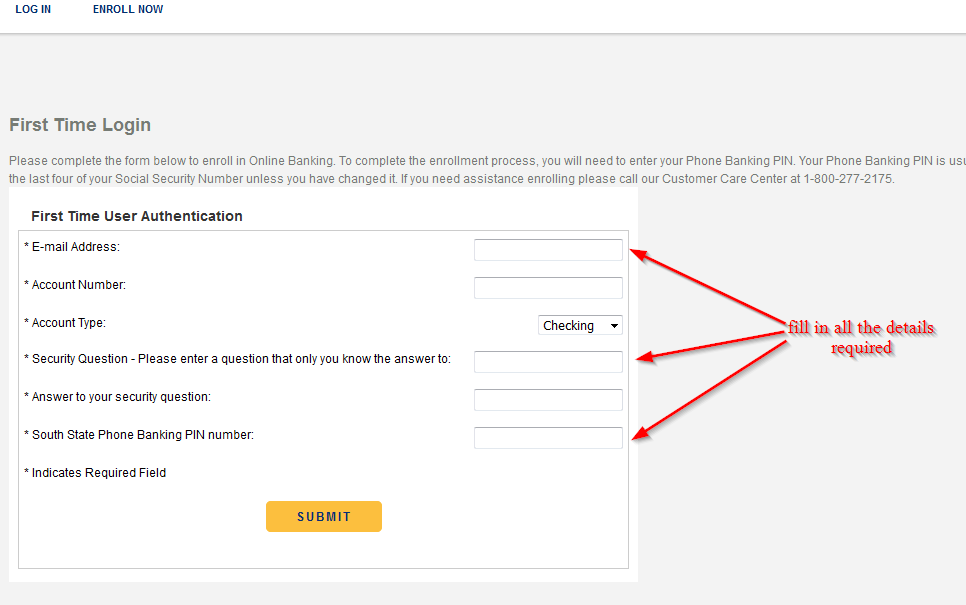

Step 1-Click “enroll now for online banking”

Step 2-Fill in the details carefully and click “submit”

Manage your South State Bank online account

When you create an online account with the bank, you’ll be able to take advantage of these benefits:

- Access your bank accounts fast

- Pay your bills

- Track your transaction history

- Get transfer alerts

South State Bank Review

South State Bank is built on the same foundation that has shaped the bank for more than 80 years. Since the bank was opened in 1934, it has expanded from a small rural community bank to large regional bank rooted in the south.

The bank’s customers now have access to locations and ATMs in three states-Georgia, South Carolina and North Carolina.

Over the last 80 years, the bank has shared it history will local communities, customers and businesses. With these relationships, the bank has been able to shape who they really are as a bank and how they conduct business.

South State Bank has a long history and track record in providing a high-touch relationship banking with stability and strength that their stability that customers have come to rely on.

Through the bank’s partnership with other banks, South State Bank now has areas where its legacy of services dates 100 years back. The bank understands the long history of these organizations and honors them as their own.

As South State Bank strives for advancement, they will continue with their legacy of service and commitment to relationship banking that certainly been a seal for the bank for more than a century.

South State Bank has a range of account options that you need to know so that you can choose the right account:

Checking accounts

South State Checking-This is the perfect account for those who like free. The account does not have a monthly maintenance charge when customers enroll for electronic statements. The account requires a minimum opening balance of $25 and unless customers enroll for eStatements, they will be required to pay a maintenance charge. The account includes image statements and wealth consultation.

- Choice checking-This is a full service account that gives you convenient access when you need it. Requires a minimum opening balance of $25 and has a monthly service charge $5.

- Customers can avoid the maintenance charges if they maintain a minimum daily balance of $3,500 or combined minimum daily balance of $10,000 or $10,000 in outstanding mortgage or consumer loans

- Classic checking-This account is designed for people who are 62 years or older and comes with expanded benefits. It requires a minimum opening balance of $25 and a monthly service charge of $8 which can be avoided if you have $1,000 average daily balance or $250 in combined direct deposits.

- Student checking-This is a convenient and simple checking account for students aged between 16 and 22. Requires a minimum opening balance $25 and monthly service charge of $3 which can be avoided when you enroll for eStatement.

- The account features wealth consultation, image statements and three South State Bank foreign fees waived monthly

Savings account

South State Bank offers a number of savings accounts:

- Smart savings-This is the most popular savings account for anyone that wants quick access to savings funds. It requires a minimum opening balance of $50, interest is paid quarterly, requires minimum balance of $200 and 3 withdrawals per quarter

- Youth savings-This is the right account for customers who under the age of 18. This account earns interest and is usually opened by a guardian or parent

- Saver’s club- This account helps you to plane ahead and saves for almost anything that you wish.

- Money market- This is an interest earning account that helps you to enjoy convenient access to your bank account

- HAS account-This is a Health Savings Account that allows those with High-Deductible Health Plan to pay qualified medical expenses

- Certificate of deposit-Customers get to enjoy locked in interest rates as money grows

Benefits

The benefits of banking with South State Bank include:

- Low minimum opening balance

- Low minimum daily balance

- Low maintenance charges

- Access to a wide network of ATMs

- Higher interest rates

- Online banking

- Mobile banking

- customer support

Downsides

Here are the downsides that you will experience when you choose South State Bank as your bank

- Some customers have complained of poor customer support

- Fraudulent charges remained unsolved for months

- Limited locations

Conclusion

South State Bank is one of the oldest banks in the United States and provides a range of services. However, many customers have complained of poor customer support services.