Alliant Credit Union is the 8th largest credit union in the United States with more than $8 billion in assets. The union was formed in 1935 by 135 members. Today, this has grown to more than 300,000 members. The bank offers four major services in the following categories: bank, borrow, invest, and protect.

- Branch / ATM Locator

- Website: http://www.alliantcreditunion.org

- Routing Number: 271081528

- Swift Code: See Details

- Telephone Number: 773-462-2000

- Mobile App: Android | iPhone

- Founded: 1935 (89 years ago)

- Bank's Rating:

Alliant Credit Union was established in 1935 by 135 members with $5000 in assets. Today, Alliant is an $8 billion credit union with more than 300,000 members. The union offers all the banking services such as savings, credit, money management, and investment. The bank offers its services branches, mobile banking, and internet banking.

HOW TO LOGIN

To login to your Alliant Credit Union online account, you should follow the steps below.

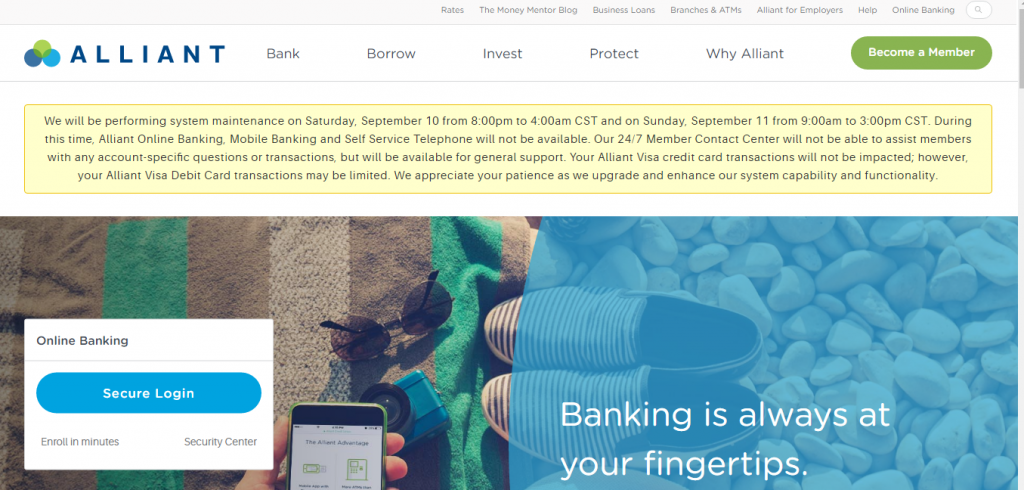

Step 1. The first step is to go to the bank’s website using this link

Step 2. On the homepage, select secure login as shown below.

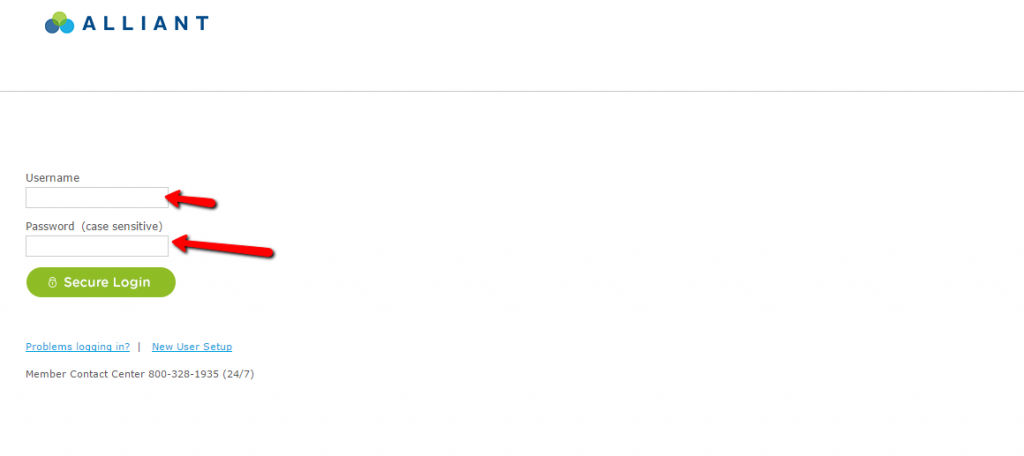

Step 3. In the next step, enter your username and password. Remember your password is case sensitive so enter it carefully.

If you enter the information carefully, you will be directed to your online account.

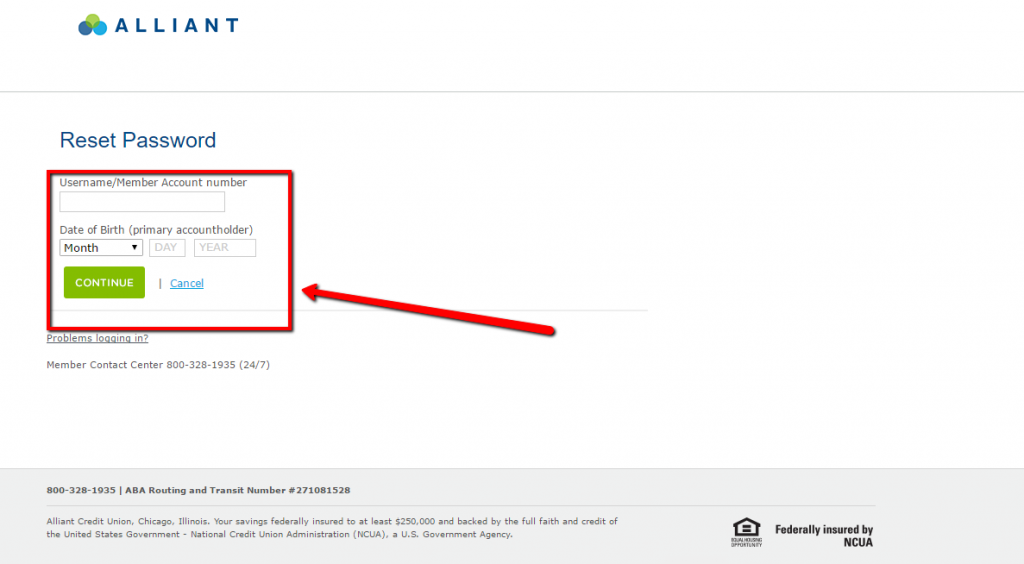

HOW TO RECOVER FORGOTTEN PASSWORD

If you have unfortunately forgotten your password, you should follow the steps below to recover it.

Step 1. The first step is to go to the website using the link above.

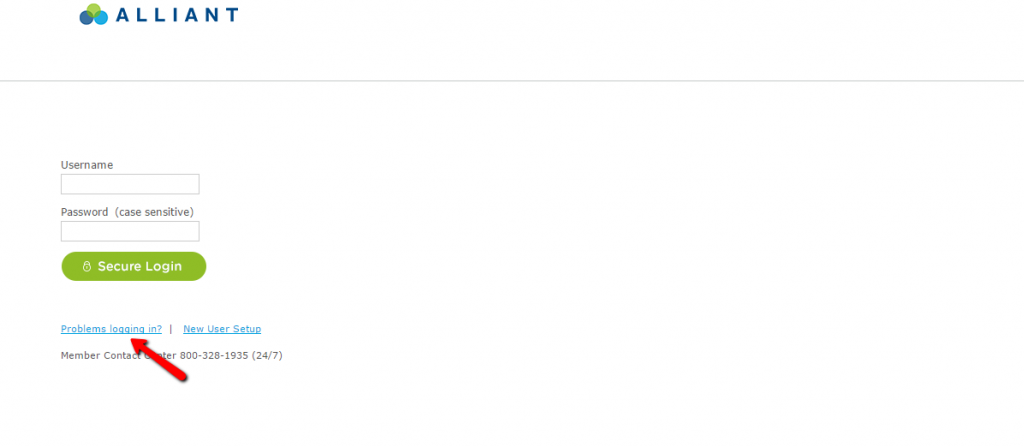

Step 2. In the homepage, click Secure Login and enter your online login page. On this page, click problems signing in.

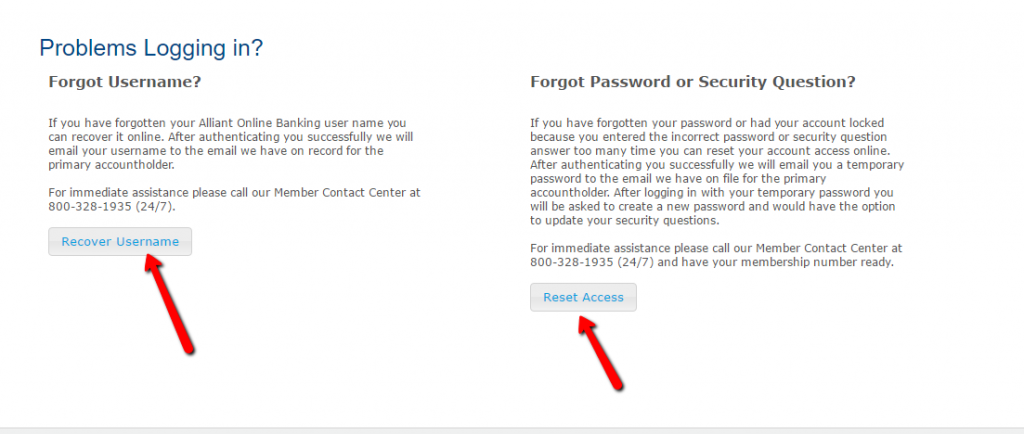

Step 3. On the next page, click Forgot Password as shown below.

Step 4. On the next page, enter your Username and date of birth and click next. This will help you recover your password.

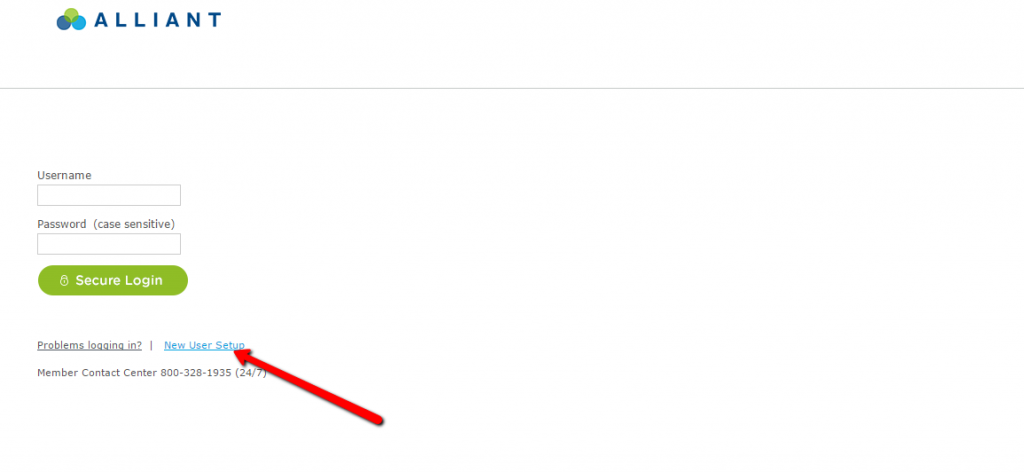

HOW TO ENROL

To enrol for online banking, you should follow the following steps.

Step 1. The first step is to enter the website, and then secure login as shown in the steps above.

Step 2. In the next step, click new user setup as shown below.

Step 3. In the next page, you should enter your account number and your date of birth as shown in 1 below.

In page 2, you should read the agreement carefully and accept it if only you find it good. In page 3, you should set up your password and secure code.

WHAT YOU WILL FIND IN THE ONLINE ACCOUNT

In the online account, you will be able to do almost all services at the convenience of your home or office using your mobile phone or computer.

Some of the services you will find online include: cash deposit, cash balance check, statement request, check deposit, and sending money.

Alliant Credit Union Review

Alliant Credit Union is a not-for-profit, member-only credit union offering a number of consolidation, loan, and banking services. The bank was founded in 1935 and is based in Chicago, Illinois. Since it is not a big bank, it can certainly keep rates relatively low.

The credit union based interest rates on a blend of the borrower’s credit score, loan amount and loan repayment history. Alliant Credit Union places a lot of emphasis on customer service by simply encouraging its customers to email or call for questions and concerns anytime.

The credit union requires an annual gross income of $40,000 from the borrower or cosigner and there are additional charges for supplemental services.

Benefits

When reviewing Alliant Credit Union, we realized that there are a number of benefits that come with becoming a member of the credit union. The benefits are many and they include:

- Customer service

Because Alliant Credit Union is not a big bank, it has been able to focus on providing good customer service to their customers. The credit union welcomes those who have questions and concerns to contact them either by email or phone. Customers can contact the credit union anytime.

- Availability

Alliant Credit Union offers student loan refinancing to all the fifty states. This is broader than the reach of many companies in the industry. The credit union is, however, more selective when it comes to the schools in which is provides refinancing services to. The credit union doesn’t provide refinancing to schools that make profit.

- Saving money

Refinancing with Alliant Credit Union save borrowers as much as $11,000 and also an average of $10,000

- No payment fee

The credit union doesn’t charge prepayment fees for people who want to pay back their debt soon. In addition, the credit union doesn’t require an application fee. These practices are fairly standard in the industry. The credit union doesn’t specify whether they charge origination fees.

Downsides

A review wouldn’t be complete without talking about the negative sides of this credit union. There are a few disadvantages that as someone who is considering becoming a member of the credit union should know. These downsides include:

- Strict eligibility terms

If you want to apply for the Alliant Credit Union consolidation program, you must meet the following requirements:

- Minimum annual income

Either the cosigner or the borrower must make an annual gross income of at least $40,000. This requirement is higher than the average and can be tricky for people who don’t have a signer or are just coming out of college

- Must be a member of the credit union

The refinancing services that are offered by Alliant Credit Union are not for members only

- Unemployment, Disability, Death protection

Although Alliant Credit Union offers unemployment, death and disability protection, one thing you should know is that these protections usually come at a price. You can purchase additional protection for an additional fee a month. Many credit unions offer supplemental protection at no extra cost

- Website lacks information

Another disadvantage of this credit union is that their website does not provide as much helpful information as it should. Although the credit union has published the lowest interest rate available, they don’t specify whether it is variable or fixed. In addition, the credit union has not elaborated on its terms. The credit union is not transparent with their pricing information and its Frequently Asked Questions page has only one question and one answer.

- Reward system information has not been provided

On the website, you will not find information stating whether the credit union offers ways for customers to discount their interest rates. Basically in the industry, refinancing and consolidation companies offer an auto pay discount. This credit union doesn’t mention any information regarding reward systems.

Conclusion

Alliant Credit Union consolidation program, together with its around the clock customer support services, provide a personal touch that has not be found with many credit unions in the industry.

The credit union is small and therefore, they focus on keeping their rates low and ensure that customers are getting the best customer service.

In addition, refinancing is offered in all the 50 states, which is much better than many companies. Although there are a few downsides of this credit union, it is generally a good credit union.