Community Bank offers business and personal banking, and wealth management services. The company was founded in 1866 and operates as a subsidiary of Community Bank System Inc.

- Branch / ATM Locator

- Website: https://www.communitybankna.com/

- Routing Number: 021307559

- Swift Code: See Details

- Telephone Number: +1 315-493-0600

- Mobile App: Android | iPhone

- Founded: 1866 (158 years ago)

- Bank's Rating:

Community Bank provides its customers with a great banking experience. The bank values its customers and the internet banking services offered by the bank make it easy for the customers to conveniently manage their banking activities. In this guide, you’ll find a step by step process on how to login into your account; password reset steps and enrolling for the internet banking services.

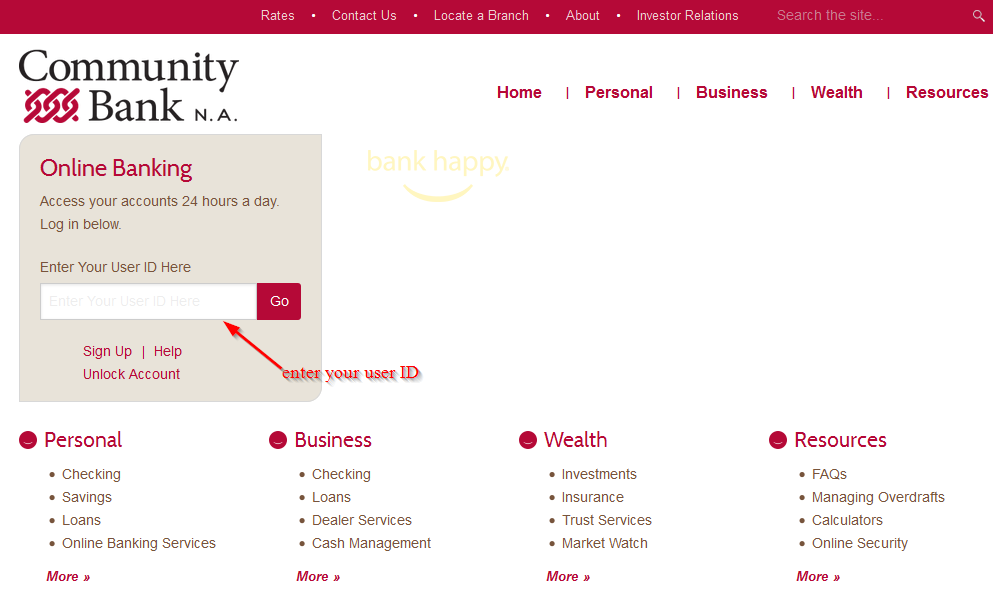

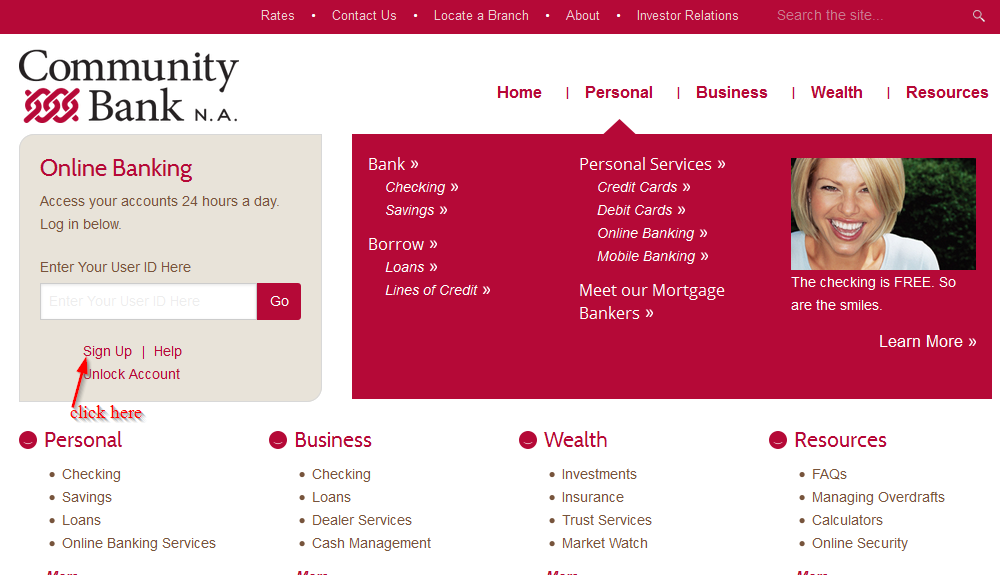

How to login

You can login into your online account anytime and manage your Community Bank online account. You will need your login ID and password to access your online account. Here are a few steps to login:

Step 1-Open https://www.communitybankna.com/ in your web browser

Step 2-Enter your user ID and click “go”

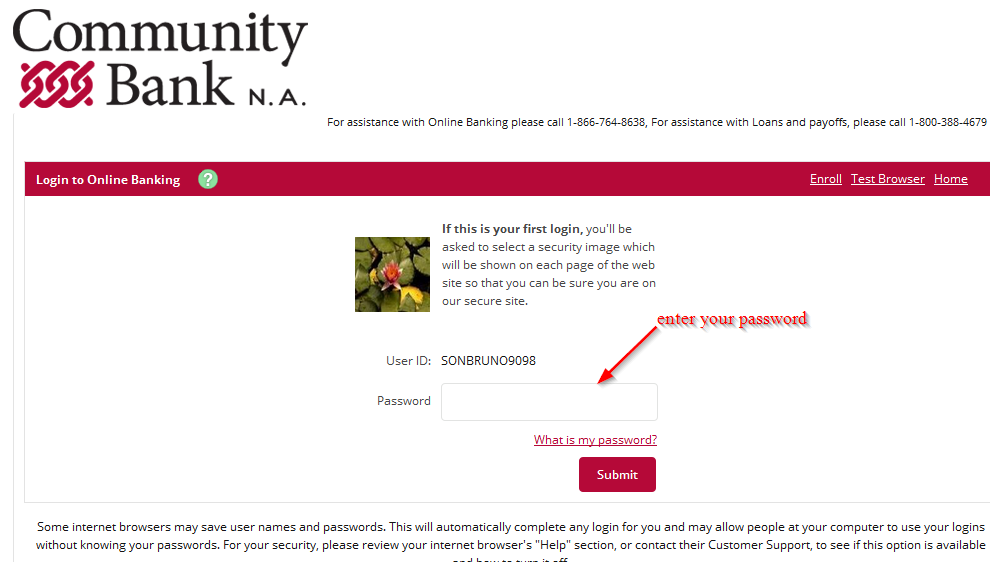

Step 3-Enter your password and click “submit”

You can access your online account from anywhere provided you are using valid logins

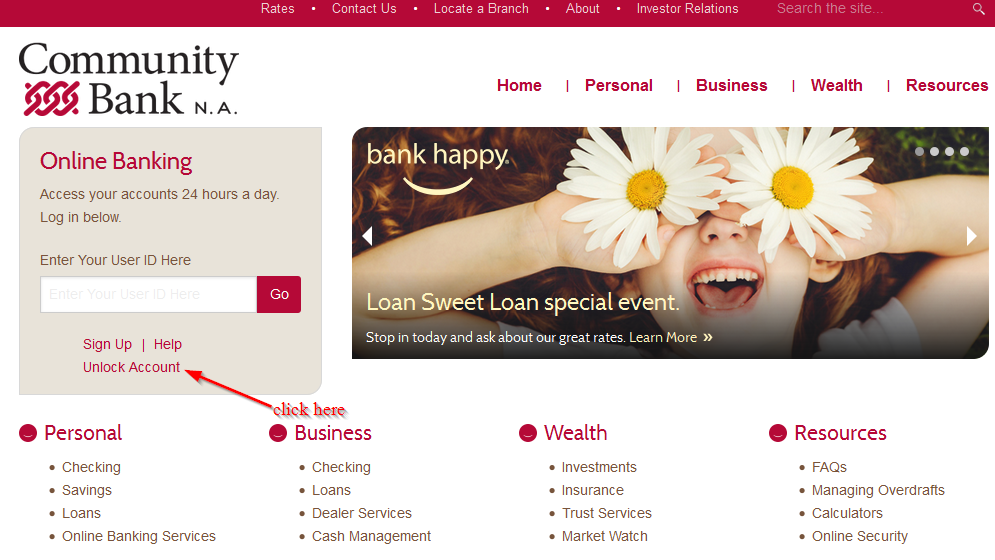

Forgot your password?

Community Bank allows customers to reset their passwords in case they forgot. You will need your user ID to reset the password. Here are the steps you need to follow:

Step 1-Click “unlock account”

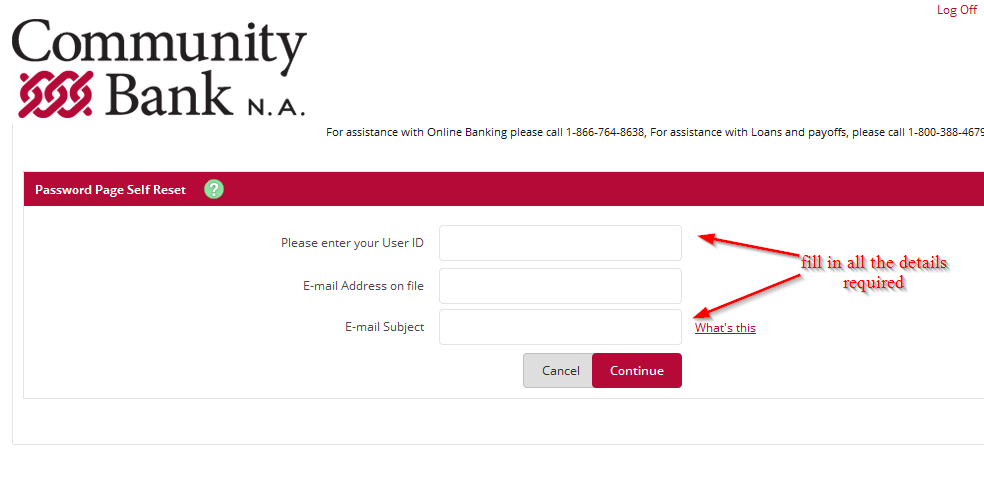

Step 2-Enter your user ID, email address and email subject and click “continue”

The bank will send you a new password via email

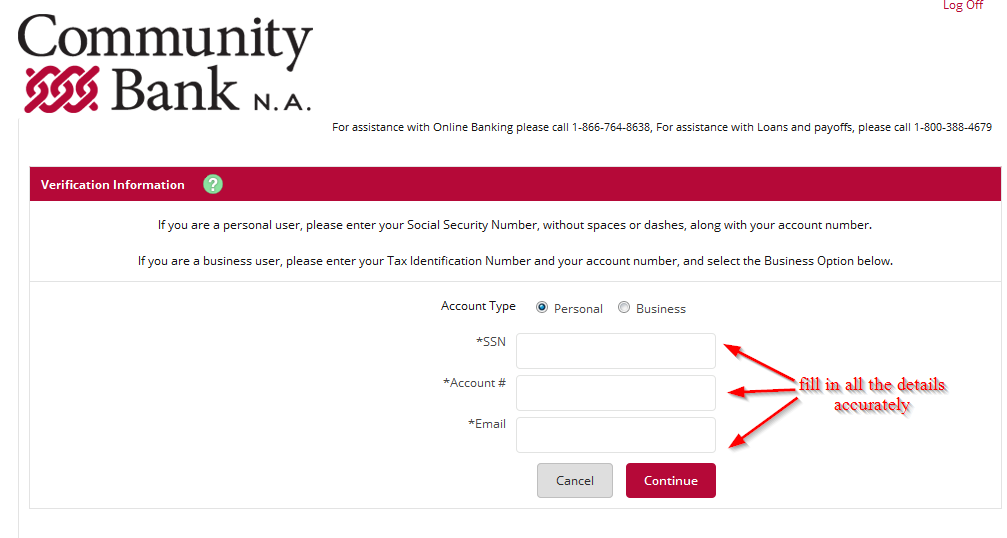

How to enroll

Enrolling for the internet banking services that are offered by Community Bank is easy as long as you are a customer with the bank. You can create an account is less than five minutes by simply following the following step by step process:

Step 1-Go to the homepage and click “sign up”

Step 2-Choose the type of account you have with the bank, whether personal or business

Step 3-Enter your social security number, account number and email address and click “continue”

Once you have provided all the information needed, your account will be registered automatically and you will have login details

Manage your Community Bank online account

After setting up an online account with Community Bank, you will be able to take advantage of these benefits:

- Online customer support

- Safe and secure platform

- Check your account balance

- Apply for loans

- Get alerts

- Access electronic statements

- Report a stolen or lost card

Community Bank Review

Community Bank is commercial bank serving clients in Massachusetts, Upstate New York, Vermont and Northeastern Pennsylvania.

The bank is a subsidiary of Community Bank System, Inc. (CBSI). CBSI is a full-service financial; institution providing complete business, consumer and financial services. Community Bank is based in DeWitt, New York and has more than 170 branches.

As of 2012, the bank had over 170 customer facilities and it is listed in the New York stock market and it is one of the largest banks in the United States.

Benefits

Founded in 1866, Community Bank is one of the oldest banks in the United States. The bank prides in providing a range of financial products to its customers, which come with a number of benefits:

Customized products

Community Bank provides solutions for individuals, businesses and wealth management clients. Regardless of the financial background or situation, the bank works to provide customized products and options to benefits customers who bank with them. The bank also offers investment and lending opportunities.

Services and features

Customers who choose to open a checking account with the bank can expect a few services and positive features that are included with all types of accounts. The bank has four different types of accounts for customers to choose from.

The accounts are designed to benefits customers with different financial situations. The account can be broken down like this:

- Free checking-The benefits of this account include no minimum service charge, free Visa debit card, no minimum balance, no per check charge, free online banking with Bill Pay, free return of check images, and free mobile deposit and mobile banking.

- VIP free interest-The benefits of this account include no minimum balance, free return of check images, no monthly service charge, and competitive interest, free Visa debit card, free mobile banking and free online banking

- 50 and better interest checking-The benefits of this account include no per check charge, competitive interest, free visa card, no monthly service charge, free mobile banking with mobile deposit, no minimum balance and free online banking.

- Wall Street Checking-The benefits of this account include competitive interest if the balance drops below $2,500, higher interest rates with $2,500 balances, an 8% charge is minimum balance drops below $1,000, free visa debit card, no per check charge, free mobile banking with deposit and free online banking.

No monthly service charge

One of the main features that give Community Bank a competitive edge over other banks is the fact that most of their accounts don’t have a monthly service charge. There are a few, but customers need to meet certain requirements in order for the fee to be waived. These requirements are also simple when compared to other banks.

Downsides

Community Bank is one of the best banks in the United States as you have seen in the benefits. However, a review wouldn’t be complete without talking about the negative side of the bank. They include:

Limited options

Although there are solutions for financing through the bank, the reality is that the options are rather limited. First, individuals must qualified and meet the specific standards that have been set before getting approved for mortgage and loans, there are not many opportunities or milestones that Community bank can finance. The bank’s loan options include:

- Personal loans-This type of loan comes with payment protections, simple payment options, and competitive rates

- Home equity loans-This type of loan has competitive fixed rates and terms at no closing costs. The interest paid may also be tax-deductible

- Home mortgages-These are fixed loan rates that include mortgage refinancing

Lack of transparency

The claims to offer competitive rates on savings and checking schools, but they don’t necessarily disclose this info. This means that it is difficult for prospective clients to determine what competitive entails and how much they should expect their money to grow over time.

Conclusion

Community Bank works hard to find solutions for all prospective customers walk through the door. The bank usually words with various situations to ensure reliable financial management moving forward. Customers who choose to use Community Bank can expect these:

- A range of personal banking options

- Most accounts don’t require a monthly service charge

- Limited loan options

- Lack of info on interest rates

- Online and mobile banking